TripAdvisor 2012 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.loss may have been incurred that would be material to the financial statements. Significant judgment is required

to determine the probability that a liability has been incurred and whether such liability is reasonably estimable.

We base accruals made on the best information available at the time which can be highly subjective. The final

outcome of these matters could vary significantly from the amounts included in the accompanying consolidated

and combined financial statements.

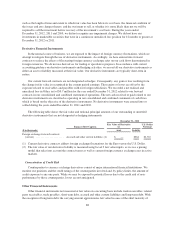

Comprehensive Loss

Comprehensive loss consists of net income (loss), cumulative foreign currency translation adjustments, and

unrealized gains and losses on available-for-sale securities, net of tax.

Earnings per Share (EPS)

As discussed above in “Note 1—Organization and Basis of Presentation”, in connection with the Spin-Off

a one-for-two reverse stock split of outstanding Expedia capital stock occurred immediately prior to the Spin-Off,

which resulted in 120,661,020 shares of common stock and 12,799,999 shares of Class B common stock

outstanding immediately following the Spin-Off.

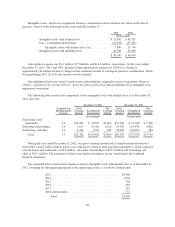

Basic Earnings Per Share

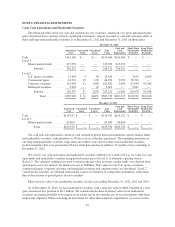

For the year ending ended December 31, 2012, we computed basic earnings per share using the number of

shares of common stock and Class B common stock outstanding as of December 31, 2011 plus the weighted

average of any additional shares issued and outstanding during the year ended December 31, 2012.

For the year ended December 31, 2011, we computed basic earnings per share using the number of shares of

common stock and Class B common stock outstanding immediately following the Spin-Off, as if such shares

were outstanding for the entire period prior to the Spin-Off, plus the weighted average of any additional shares

issued and outstanding following the Spin-Off date through December 31, 2011.

For the year ended December 31, 2010, we computed basic earnings per share using the number of shares of

common stock and Class B common stock outstanding immediately following the Spin-Off, as if such shares

were outstanding for the entire period.

Diluted Earnings Per Share

For the year ended December 31, 2012, we computed diluted earnings per share using (i) the number of

shares of common stock and Class B common stock outstanding at December 31, 2011, (ii) the weighted average

of any additional shares issued and outstanding for the year ended December 31, 2012, and (iii) if dilutive, the

incremental weighted average common stock that we would issue upon the assumed exercise of common

equivalent shares related to stock options, stock warrants and the vesting of restricted stock units using the

treasury stock method during the year ended December 31, 2012, and (iv) if dilutive, performance based awards

based on the number of shares that would be issuable as of the end of the reporting period assuming the end of

the reporting period was also the end of the contingency period.

For the year ended December 31, 2011, we computed diluted earnings per share using (i) the number of

shares of common stock and Class B common stock outstanding immediately following the Spin-Off, (ii) the

weighted average of any additional shares issued and outstanding shares outstanding following the Spin-Off date

through December 31, 2011, and (iii) if dilutive, the incremental weighted average common stock that we would

issue upon the assumed exercise of common equivalent shares related to stock options, stock warrants and the

vesting of restricted stock units using the treasury stock method during the year ended December 31, 2011, and

(iv) if dilutive, performance based awards based on the number of shares that would be issuable as of the end of

the reporting period assuming the end of the reporting period was also the end of the contingency period. We

treated all outstanding equity awards assumed at Spin-Off as if they were granted as of the Spin-Off and we

80