TripAdvisor 2012 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

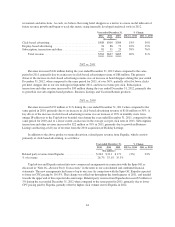

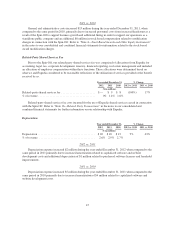

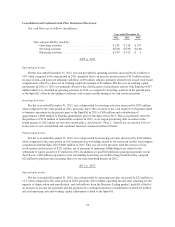

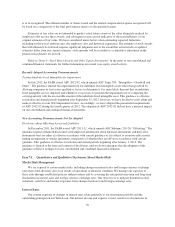

Contractual Obligations, Commercial Commitments and Off-Balance Sheet Arrangements

The following table summarizes our material contractual obligations and minimum commercial

commitments as of December 31, 2012:

By Period

Total

Less than

1 year 1 to 3 years 3 to 5 years

More than

5 years

(In thousands)

Term Loan(1) ................................. $380,000 $40,000 $ 80,000 $260,000 $ —

Expected interest payments on Term Loan(1) ........ 25,029 7,519 12,566 4,944 —

Chinese credit facilities(1) ....................... 32,145 32,145 — — —

Operating leases ............................... 23,782 6,730 8,436 2,558 6,058

Purchase obligations(2) ......................... 1,441 586 747 108 —

Total(3)(4) ................................... $462,397 $86,980 $101,749 $267,610 $6,058

(1) The amounts included as expected interest payments on the Term Loan in this table are based on the current

effective interest rate and payment terms as of December 31, 2012, but, could change significantly in the

future. Amounts assume that our existing debt is repaid at maturity and do not assume additional borrowings

or refinancings of existing debt. See “Note 8—Debt” in the notes to the consolidated and combined financial

statements for additional information on our Term Loan and Chinese Credit Facilities.

(2) Excludes amounts already recorded on the consolidated balance sheet at December 31, 2012.

(3) Excluded from the table was $23 million of unrecognized tax benefits, including interest and penalties, that

we have recorded in other long-term liabilities for which we cannot make a reasonably reliable estimate of

the amount and period of payment. We estimate that none of these amounts will be paid within the next

year.

(4) In connection with the Spin-Off, we assumed Expedia’s obligation to fund a charitable foundation. The

Board of Directors of the charitable foundation is currently comprised of Stephen Kaufer- President and

Chief Executive Officer, Julie M.B. Bradley-Chief Financial Officer and Seth J. Kalvert- Senior Vice

President, General Counsel and Secretary. Our obligation was calculated at 2.0% of OIBA in 2012 and is

expected to be calculated at 2.0% of Adjusted EBITDA for subsequent years. For a discussion regarding

OIBA and Adjusted EBITDA see “Note 17—Segment Information” in the notes to the consolidated and

combined financial statements. This future commitment has been excluded from the table above.

Off-Balance Sheet Arrangements

As of December 31, 2012, we did not have any off-balance sheet arrangements that have, or are reasonably

likely to have, a current or future effect on our financial condition, results of operations, liquidity, capital

expenditures or capital resources.

Contingencies

In the ordinary course of business, we and our subsidiaries are parties to legal proceedings and claims

involving alleged infringement of third-party intellectual property rights, defamation, and other claims. Rules of

the SEC require the description of material pending legal proceedings, other than ordinary, routine litigation

incident to the registrant’s business, and advise that proceedings ordinarily need not be described if they

primarily involve damages claims for amounts (exclusive of interest and costs) not individually exceeding 10%

of the current assets of the registrant and its subsidiaries on a consolidated basis. In the judgment of management,

none of the pending litigation matters that the Company and its subsidiaries are defending involves or is likely to

involve amounts of that magnitude. There may be claims or actions pending or threatened against us of which we

are currently not aware and the ultimate disposition of which could have a material adverse effect on us.

52