TripAdvisor 2012 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

of our common stock on the date of grant. Stock options granted during the year ended December 31, 2012 have

a term of ten years from the date of grant and generally vest over a four-year requisite service period.

During the year ended December 31, 2012, we have issued 3,650,814 of primarily service based stock

options under the 2011 Incentive Plan with a weighted average estimated grant-date fair value per option of

$20.36. During the year ended December 31, 2011, we did not grant any stock options under the 2011 Incentive

Plan. We will amortize the fair value of the 2012 grants, net of estimated forfeitures, as stock-based

compensation expense over the vesting term of generally four years on a straight-line basis, with the amount of

compensation expense recognized at any date at least equaling the portion of the grant-date fair value of the

award that is vested at that date.

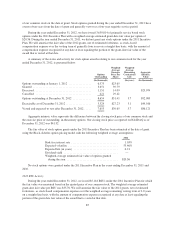

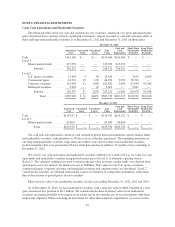

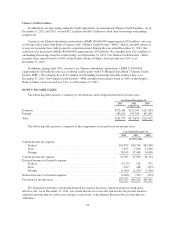

A summary of the status and activity for stock option awards relating to our common stock for the year

ended December 31, 2012, is presented below:

Options

Outstanding

Weighted

Average

Exercise

Price Per

Share

Weighted

Average

Remaining

Contractual

Life

Aggregate

Intrinsic

Value

(In thousands) (In years) (In thousands)

Options outstanding at January 1, 2012 ................ 6,575 $23.65

Granted ......................................... 3,651 39.79

Exercised ........................................ 1,151 14.09 $25,074

Cancelled ....................................... 421 29.42

Options outstanding at December 31, 2012 ............. 8,654 $31.41 5.7 $92,083

Exercisable as of December 31, 2012 .................. 3,329 $27.23 3.1 $49,016

Vested and expected to vest after December 31, 2012 ..... 7,655 $30.65 5.7 $86,121

Aggregate intrinsic value represents the difference between the closing stock price of our common stock and

the exercise price of outstanding, in-the-money options. Our closing stock price as reported on NASDAQ as of

December 31, 2012 was $41.92.

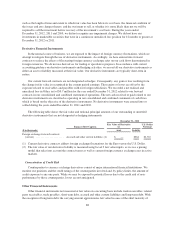

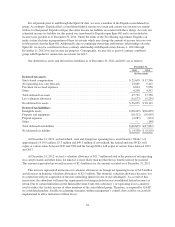

The fair value of stock option grants under the 2011 Incentive Plan has been estimated at the date of grant

using the Black–Scholes option pricing model with the following weighted average assumptions:

2012

Risk-free interest rate ................................. 1.03%

Expected volatility ................................... 53.46%

Expected life (in years) ............................... 6.21

Dividend yield ...................................... —

Weighted-average estimated fair value of options granted

during the year .................................... $20.36

No stock options were granted under the 2011 Incentive Plan in the years ending December 31, 2011 and

2010.

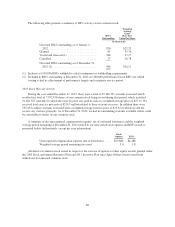

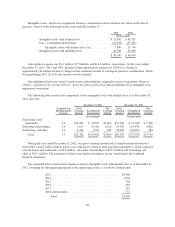

2012 RSU Activity

During the year ended December 31, 2012, we issued 85,144 RSUs under the 2011 Incentive Plan for which

the fair value was measured based on the quoted price of our common stock. The weighted average estimated

grant-date fair value per RSU was $35.76. We will amortize the fair value of the 2012 grants, net of estimated

forfeitures, as stock-based compensation expense over the weighted average remaining vesting term of 2.0 years

on a straight-line basis, with the amount of compensation expense recognized at any date at least equaling the

portion of the grant-date fair value of the award that is vested at that date.

85