TripAdvisor 2012 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(4) See our consolidated and combined statements of changes in stockholders’ equity and “Note 15—Stockholders’

Equity” in the notes to the consolidated and combined financial statements in Item 8 below for additional

information on changes to our stockholders’ equity and invested capital.

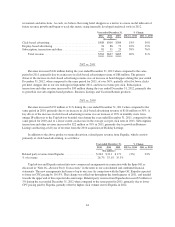

(5) To provide investors with additional information regarding our financial results, we have disclosed Adjusted

EBITDA, a non-GAAP financial measure, within this Annual Report on Form 10-K. Adjusted EBITDA is the

primary metric by which management evaluates the performance of our business and on which internal budgets

are based. We define “Adjusted EBITDA” as operating income, excluding depreciation of property and

equipment, which includes internal use software and website development, amortization of intangible assets,

stock-based compensation and non-recurring expenses incurred to affect the Spin-Off from Expedia during the

year ended December 31, 2011. See a discussion of “Adjusted EBITDA” in Item 7 “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” within this Annual Report on Form 10-K.

We have provided a reconciliation below of adjusted EBITDA to operating income, the most directly

comparable GAAP financial measure.

Year Ended December 31,

2012 2011 2010 2009 2008

(in thousands)

Reconciliation of Adjusted EBITDA:

Adjusted EBITDA ........................... $352,474 $322,918 $260,963 $197,219 $146,626

Depreciation ............................. (19,966) (18,362) (12,871) (9,330) (5,022)

Amortization of intangible assets ............. (6,110) (7,523) (14,609) (13,806) (11,161)

Stock-based compensation(1) ............... (30,102) (17,344) (7,183) (5,905) (5,560)

Spin-off costs ............................ — (6,932) — — —

Operating income ............................. $296,296 $272,757 $226,300 $168,178 $124,883

(1) Includes a one-time expense of $8 million for the year ended December 31, 2011, the majority of which was

recorded to general and administrative expense, primarily due to the modification of vested Expedia stock

options that were unexercised at the date of the Spin-Off. See “Note 4—Stock Based Awards and Other

Equity Instruments” in the notes to the consolidated and combined financial statements in Item 8 below for

additional information on our stock-based compensation.

36