TripAdvisor 2012 Annual Report Download - page 176

Download and view the complete annual report

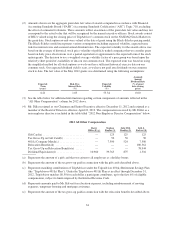

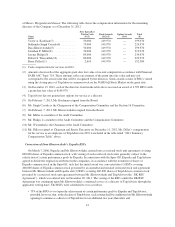

Please find page 176 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(1) Based on information filed on a Schedule 13D/A(1) with the SEC on December 11, 2012 by Liberty and

Mr. Diller (the “Liberty/Diller Schedule 13D”) and the Company’s records. Consists of 18,159,752 shares of

Common Stock and 12,799,999 shares of Class B Common Stock owned by Liberty. Excludes shares beneficially

owned by the executive officers and directors of Liberty, as to which Liberty disclaims beneficial ownership.

(2) Based solely on information filed on a Schedule 13G/A with the SEC on April 10, 2013 by FMR LLC, the

parent holding company of Fidelity Management & Research Company (“Fidelity”). Edward C. Johnson 3d

and FMR LLC, through its control of Fidelity, and the Fidelity funds (“Funds”) each has sole power to

dispose of the 12,189,188 shares owned by the Funds. Neither FMR LLC nor Edward C. Johnson 3d,

Chairman of FMR LLC, has the sole power to vote or direct the voting of the shares owned directly by the

Fidelity Funds, which power resides with the Funds’ Boards of Trustees. Fidelity carries out the voting of

the shares under written guidelines established by the Funds’ Boards of Trustees.

(3) Based solely on information filed on a Schedule 13G/A with the SEC on February 14, 2013 by Lone Pine

Capital LLC. Lone Pine Capital LLC, a Delaware limited liability company (“Lone Pine Capital”), which

serves as investment manager to Lone Spruce, L.P., a Delaware limited partnership (“Lone Spruce”),

Lone Balsam, L.P., a Delaware limited partnership (“Lone Balsam”), Lone Sequoia, L.P., a Delaware

limited partnership (“Lone Sequoia”), Lone Cascade, L.P., a Delaware limited partnership (“Lone

Cascade”), Lone Sierra, L.P., a Delaware limited partnership (“Lone Sierra”), Lone Cypress, Ltd., a Cayman

Islands exempted company (“Lone Cypress”), Lone Kauri, Ltd., a Cayman Islands exempted company

(“Lone Kauri”) and Lone Monterey Master Fund, Ltd., a Cayman Islands exempted company (“Lone

Monterey Master Fund”, and together with Lone Spruce, Lone Balsam, Lone Sequoia, Lone Cascade,

Lone Sierra, Lone Cypress, Lone Kauri and Lone Monterey Master Fund, the “Lone Pine Funds”), with

respect to the common stock directly held by each of the Lone Pine Funds. Stephen F. Mandel, Jr., the

managing member of Lone Pine Managing Member LLC, which is the Managing Member of Lone Pine

Capital, with respect to the common stock directly held by each of the Lone Pine Funds.

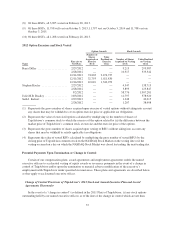

(4) Based on information filed March 4, 2013 on Form 4 by the Company and the Company’s records. Consists

of (i) 52,329 shares of common stock owned by Mr. Diller, and (ii) options to purchase 2,019,694 shares of

common stock held by Mr. Diller that are currently exercisable or will be exercisable within 60 days of

May 1, 2013. Excludes shares of common stock and options to purchase shares of common stock held by

Mr. Diller’s spouse, as to which Mr. Diller disclaims beneficial ownership.

(5) Includes options to purchase 296,093 shares of common stock that are currently exercisable or will be

exercisable within 60 days of May 1, 2013.

(6) Represents 1,938 shares of common stock that are held by Maffei Foundation.

(7) Includes options to purchase 25,000 shares of common stock that are currently exercisable or will be

exercisable within 60 days of May 1, 2013.

(8) Includes options to purchase 60,943 shares of common stock that are currently exercisable or will be

exercisable within 60 days of May 1, 2013.

(9) Includes options to purchase 2,401,730 shares of common stock that are currently exercisable or will be

exercisable within 60 days of May 1, 2013.

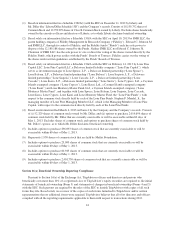

Section 16(a) Beneficial Ownership Reporting Compliance

Pursuant to Section 16(a) of the Exchange Act, TripAdvisor officers and directors and persons who

beneficially own more than 10% of a registered class of TripAdvisor’s equity securities are required to file initial

statements of beneficial ownership (Form 3) and statements of changes in beneficial ownership (Forms 4 and 5)

with the SEC. Such persons are required by the rules of the SEC to furnish TripAdvisor with copies of all such

forms they file. Based solely on a review of the copies of such forms furnished to TripAdvisor and/or written

representations that no additional forms were required, TripAdvisor believes that all of its directors and officers

complied with all the reporting requirements applicable to them with respect to transactions during 2012.

44