TripAdvisor 2012 Annual Report Download - page 61

Download and view the complete annual report

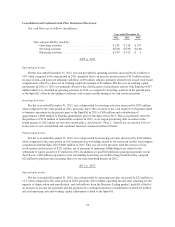

Please find page 61 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Prepayments

We may voluntarily repay any outstanding borrowing under the Credit Agreement at any time without

premium or penalty, other than customary breakage costs with respect to eurocurrency loans.

Guarantees

All obligations under the Credit Agreement are unconditionally guaranteed by us and each of our existing

and subsequently acquired or organized direct or indirect wholly-owned domestic and foreign restricted

subsidiaries, subject to certain exceptions for controlled foreign corporations, foreign subsidiaries where

applicable law would otherwise be violated or non-material subsidiaries.

Covenants

The Credit Agreement contains a number of covenants that, among other things, restrict our ability to: incur

additional indebtedness, create liens, enter into sale and leaseback transactions, engage in mergers or

consolidations, sell or transfer assets, pay dividends and distributions or repurchase our capital stock, make

investments, loans or advances, prepay certain subordinated indebtedness, make certain acquisitions, engage in

certain transactions with affiliates, amend material agreements governing certain subordinated indebtedness, and

change our fiscal year. The Credit Agreement also requires us to maintain a maximum leverage ratio and a

minimum cash interest coverage ratio, and contains certain customary affirmative covenants and events of

default, including a change of control. If an event of default occurs, the lenders under the Credit Agreement will

be entitled to take various actions, including the acceleration of all amounts due under Credit Agreement and all

actions permitted to be taken by a secured creditor.

As of December 31, 2012 we believe we are in compliance with all of our debt covenants.

Refer to “Note 8—Debt” in the notes to the consolidated and combined financial statements for additional

information on our Credit Agreement. The full text of the Credit Agreement, by and among TripAdvisor,

TripAdvisor Holdings, LLC, and TripAdvisor LLC, the lenders party thereto, JPMorgan Chase Bank, N.A., as

administrative agent, and J.P. Morgan Europe Limited, as London agent, dated as of December 20, 2011, is

incorporated by reference in this Annual Report on Form 10-K as Exhibit 4.2.

Chinese Credit Facilities

In addition to our borrowings under the Credit Agreement, we maintain our Chinese Credit Facilities. As of

December 31, 2012 and 2011, we had $32.1 million and $16.7 million of short term borrowings outstanding,

respectively.

Certain of our Chinese subsidiaries entered into a RMB 138,600,000 (approximately $22 million), one-year

revolving credit facility with Bank of America (the “Chinese Credit Facility—BOA”) that is currently subject to

review on a periodic basis with no specific expiration date. During the year ended December 31, 2012, this credit

line was increased to RMB 189,000,000 (approximately $30 million). We currently have $21.8 million of

outstanding borrowings from this credit facility as of December 31, 2012. Our Chinese Credit Facility—BOA

currently bears interest based at 100% of the People’s Bank of China’s base rate and was 5.6% as of

December 31, 2012.

In addition, during April 2012, certain of our Chinese subsidiaries entered into a RMB 125,000,000

(approximately $20 million) one-year revolving credit facility with J.P. Morgan Chase Bank (“Chinese Credit

Facility-JPM”). We currently have $10.3 million of outstanding borrowings from this credit facility as of

December 31, 2012. Our Chinese Credit Facility—JPM currently bears interest based at 100% of the People’s

Bank of China’s base rate and was 5.6% as of December 31, 2012.

51