TripAdvisor 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Investing Activities

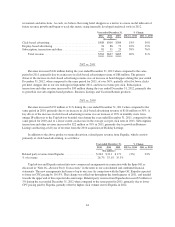

For the year ended December 31, 2011, net cash used in investing activities increased by $399 million or

286% when compared to the same period in 2010 primarily due to a distribution of approximately $406 million

paid to Expedia immediately prior to the Spin-Off, higher net cash transfers to Expedia related to business

operations between us and Expedia prior to Spin-Off of $30 million and, in October 2011, an acquisition of a

common control subsidiary in China from Expedia for $28 million, net of cash acquired, partially offset by a

decrease of $27 million in cash paid for business acquisitions and a maturity of a short term investment of $20

million.

Financing Activities

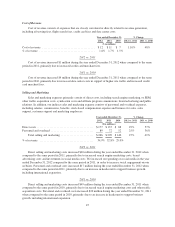

For the year ended December 31, 2011, net cash provided by financing activities increased $408 million

when compared to the same period in 2010, primarily due to our term loan facility borrowing in conjunction with

the Spin-Off of $400 million and additional short-term borrowings of $16 million, consisting of $10 million from

our new revolving credit facility related to the Spin-Off and an additional $6 million related to our existing

revolving credit facility in China. This was partially offset by a payment of a contingent purchase consideration

of which $10 million affected cash used in financing activities.

Related Party Transactions

For information on our relationships with Expedia, Barry Diller and Liberty Interactive Corporation and

recent material transactions and change in voting control in the fourth quarter of 2012, refer to “Note 16 –

Related Party Transactions” in the notes to our consolidated and combined financial statements.

Critical Accounting Policies and Estimates

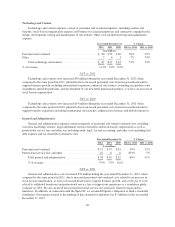

Critical accounting policies and estimates are those that we believe are important in the preparation of our

consolidated and combined financial statements because they require that management use judgment and

estimates in applying those policies. We prepare our consolidated and combined financial statements and

accompanying notes in accordance with GAAP.

Preparation of the consolidated and combined financial statements and accompanying notes requires that

management make estimates and assumptions that affect the reported amounts of assets and liabilities and the

disclosure of contingent assets and liabilities as of the date of the consolidated and combined financial statements

as well as revenue and expenses during the periods reported. Management bases its estimates on historical

experience, where applicable, and other assumptions that it believes are reasonable under the circumstances.

Actual results may differ from estimates under different assumptions or conditions.

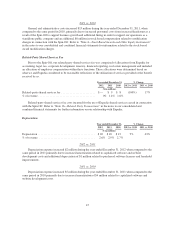

There are certain critical estimates that we believe require significant judgment in the preparation of the

consolidated and combined financial statements. We consider an accounting estimate to be critical if:

• It requires us to make an assumption because information was not available at the time or it included

matters that were highly uncertain at the time management was making the estimate; and/or

• Changes in the estimate or different estimates that management could have selected may have had a

material impact on our financial condition or results of operations.

For more information on each of these policies, see “Note 2—Significant Accounting Policies” in the notes

to our consolidated and combined financial statements. A discussion of information about the nature and

rationale for our critical accounting estimates is below.

54