TripAdvisor 2012 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

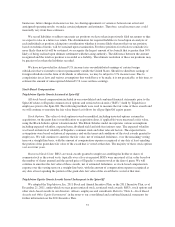

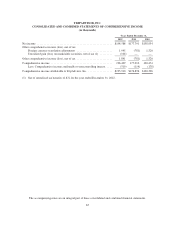

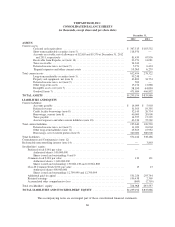

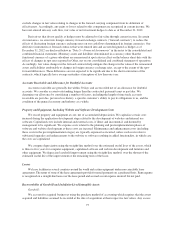

TRIPADVISOR, INC.

CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

December 31,

2012 2011

ASSETS

Current assets:

Cash and cash equivalents ............................................. $ 367,515 $ 183,532

Short-term marketable securities (note 5) .................................. 118,970 —

Accounts receivable, net of allowance of $2,818 and $5,370 at December 31, 2012

and 2011, respectively .............................................. 81,459 67,936

Receivable from Expedia, net (note 16) ................................... 23,971 14,081

Taxes receivable ..................................................... 24,243 —

Deferred income taxes, net (note 9) ...................................... 5,971 6,494

Prepaid expenses and other current assets ............................. 10,365 6,279

Total current assets ........................................................... 632,494 278,322

Long-term marketable securities (note 5) .................................. 99,248 —

Property and equipment, net (note 6) ..................................... 43,802 34,754

Deferred income taxes, net (note 9) ...................................... 502 —

Other long-term assets ................................................ 13,274 11,888

Intangible assets, net (note 7) ........................................... 38,190 44,030

Goodwill (note 7) .................................................... 471,684 466,892

TOTAL ASSETS ........................................................... $1,299,194 $ 835,886

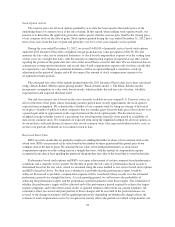

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable .................................................... $ 14,099 $ 5,903

Deferred revenue ..................................................... 31,563 19,395

Credit facility borrowings (note 8) ....................................... 32,145 26,734

Borrowings, current (note 8) ............................................ 40,000 20,000

Taxes payable ....................................................... 14,597 17,229

Accrued expenses and other current liabilities (note 10) ...................... 63,236 37,269

Total current liabilities ........................................................ 195,640 126,530

Deferred income taxes, net (note 9) ...................................... 11,023 16,004

Other long-term liabilities (note 11) ...................................... 25,563 15,952

Borrowings, net of current portion (note 8) ................................ 340,000 380,000

Total Liabilities .............................................................. 572,226 538,486

Commitments and Contingencies (note 12)

Redeemable noncontrolling interest (note 14) ...................................... — 3,863

Stockholders’ equity:

Preferred stock $.001 par value ............................................. — —

Authorized shares: 100,000,000

Shares issued and outstanding: 0 and 0

Common stock $.001 par value ............................................. 130 121

Authorized shares: 1,600,000,000

Shares issued and outstanding: 130,060,138 and 120,661,808

Class B Common Stock $.001 par value ...................................... 13 13

Authorized shares 400,000,000

Shares issued and outstanding: 12,799,999 and 12,799,999

Additional paid-in capital .................................................. 531,256 293,744

Retained earnings ........................................................ 196,438 2,369

Accumulated other comprehensive loss ....................................... (869) (2,710)

Total stockholders’ equity .................................................. 726,968 293,537

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY ....................... $1,299,194 $ 835,886

The accompanying notes are an integral part of these consolidated financial statements.

66