TripAdvisor 2012 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

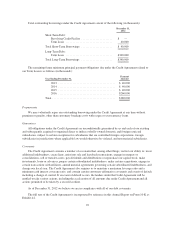

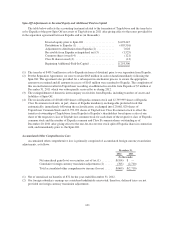

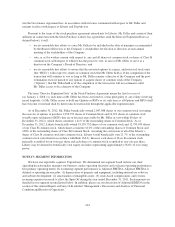

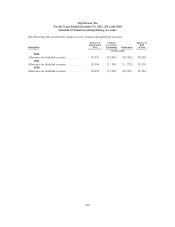

Spin-Off Adjustments to Invested Equity and Additional Paid-in Capital

The table below reflects the accounting treatment related to the formation of TripAdvisor and the transfer to

us by Expedia of the post-Spin-Off net assets of TripAdvisor in 2011 after giving effect to the terms provided for

in the separation agreement between Expedia and us (in thousands).

Invested equity prior to Spin-Off ..................... $693,447

Distribution to Expedia (1) .......................... (405,516)

Adjustment to distribution from Expedia (2) ............ 7,028

Receivable from Expedia extinguished, net (3) .......... (1,525)

Common shares issued (4) .......................... (121)

Class B shares issued (4) ............................ (13)

Beginning Additional-Paid-In-Capital ................. $293,300

(1) The transfer of $405.5 million in cash to Expedia in form of dividend, prior to our separation from Expedia.

(2) Per the Separation Agreement, we were to retain $165 million in cash on hand immediately following the

Spin-Off. The agreement also provided for a subsequent reconciliation process to ensure the appropriate

amount was retained and all amounts in excess of $165 million were remitted to Expedia. The completion of

this reconciliation resulted in TripAdvisor recording an additional receivable from Expedia of $7 million at

December 31, 2011 which was subsequently received by us during 2012.

(3) The extinguishment of domestic intercompany receivables from Expedia, including transfers of assets and

liabilities at Spin-Off.

(4) The reclassification of 120,661,020 shares of Expedia common stock and 12,799,999 shares of Expedia

Class B common stock into, in part, shares of Expedia mandatory exchangeable preferred stock that

automatically, immediately following the reclassification, exchanged into 120,661,020 shares of

TripAdvisor Common Stock and 12,799,999 shares of TripAdvisor Class B common stock to effect the

transfer of ownership of TripAdvisor from Expedia to Expedia’s shareholders based upon a ratio of one

share of the respective class of TripAdvisor common stock for each share of the respective class of Expedia

common stock and the number of Expedia common and Class B common shares outstanding as of

December 20, 2011 after giving effect to the one-for-two reverse stock split of Expedia shares in connection

with, and immediately prior to, the Spin-Off.

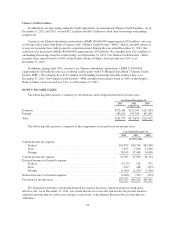

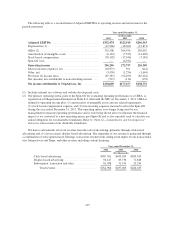

Accumulated Other Comprehensive Loss

Accumulated other comprehensive loss is primarily comprised of accumulated foreign currency translation

adjustments, as follows:

December 31,

2012 2011

(In thousands)

Net unrealized gain (loss) on securities, net of tax (1) ....... $(104) $ —

Cumulative foreign currency translation adjustments (2) ..... (765) (2,710)

Total accumulated other comprehensive income (losses) ..... $(869) $(2,710)

(1) Net of unrealized tax benefits of $72 for the year ended December 31, 2012.

(2) Our foreign subsidiary earnings are considered indefinitely reinvested; therefore; deferred taxes are not

provided on foreign currency translation adjustments.

101