TripAdvisor 2012 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

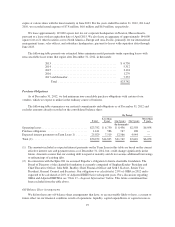

Chinese Credit Facilities

In addition to our borrowings under the Credit Agreement, we maintain our Chinese Credit Facilities. As of

December 31, 2012 and 2011, we had $32.1 million and $16.7 million of short term borrowings outstanding,

respectively.

Certain of our Chinese subsidiaries entered into a RMB 138,600,000 (approximately $22 million), one-year

revolving credit facility with Bank of America (the “Chinese Credit Facility—BOA”) that is currently subject to

review on a periodic basis with no specific expiration period. During the year ended December 31, 2012, this

credit line was increased to RMB 189,000,000 (approximately $30 million). We currently have $21.8 million of

outstanding borrowings from this credit facility as of December 31, 2012. Our Chinese Credit Facility—BOA

currently bears interest based at 100% of the People’s Bank of China’s base rate and was 5.6% as of

December 31, 2012.

In addition, during April 2012, certain of our Chinese subsidiaries entered into a RMB 125,000,000

(approximately $20 million) one-year revolving credit facility with J.P. Morgan Chase Bank (“Chinese Credit

Facility-JPM”). We currently have $10.3 million of outstanding borrowings from this credit facility as of

December 31, 2012. Our Chinese Credit Facility—JPM currently bears interest based at 100% of the People’s

Bank of China’s base rate and was 5.6% as of December 31, 2012.

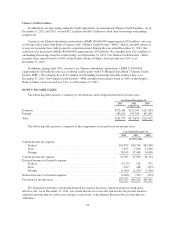

NOTE 9: INCOME TAXES

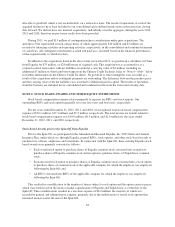

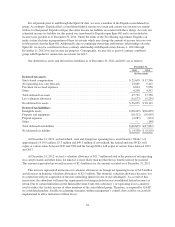

The following table presents a summary of our domestic and foreign income before income taxes:

Year Ended December 31,

2012 2011 2010

(In thousands)

Domestic ....................................................... $133,361 $121,100 $121,964

Foreign ........................................................ 148,614 150,794 102,451

Total .......................................................... $281,975 $271,894 $224,415

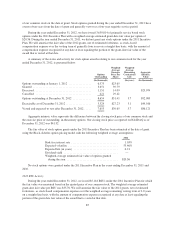

The following table presents a summary of the components of our provision for income taxes:

Year Ended December 31,

2012 2011 2010

(In thousands)

Current income tax expense:

Federal ....................................................... $55,877 $49,736 $42,568

State ......................................................... 5,927 7,818 13,490

Foreign ....................................................... 30,543 37,480 30,056

Current income tax expense ........................................... 92,347 95,034 86,114

Deferred income tax (benefit) expense:

Federal ....................................................... (3,113) 216 972

State ......................................................... (347) 148 (215)

Foreign ....................................................... (1,500) (1,295) (1,410)

Deferred income tax (benefit) expense: .................................. (4,960) (931) (653)

Provision for income taxes ............................................ $87,387 $94,103 $85,461

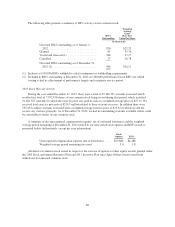

For all periods presented, current and deferred tax expense has been computed using our stand-alone

effective rate. As of December 31, 2012, our current income tax receivable and income tax payable balances

represent amounts that we will receive and pay, respectively, to the Internal Revenue Service and other tax

authorities.

93