TripAdvisor 2012 Annual Report Download - page 108

Download and view the complete annual report

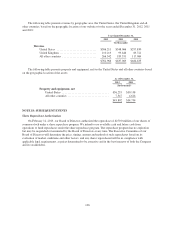

Please find page 108 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Contingencies:

In the ordinary course of business, we and our subsidiaries are parties to legal proceedings and claims

involving alleged infringement of third-party intellectual property rights, defamation, and other claims. Rules of

the SEC require the description of material pending legal proceedings, other than ordinary, routine litigation

incident to the registrant’s business, and advise that proceedings ordinarily need not be described if they

primarily involve damages claims for amounts (exclusive of interest and costs) not individually exceeding 10%

of the current assets of the registrant and its subsidiaries on a consolidated basis. In the judgment of management,

none of the pending litigation matters that the Company and its subsidiaries are defending involves or is likely to

involve amounts of that magnitude. There may be claims or actions pending or threatened against us of which we

are currently not aware and the ultimate disposition of which could have a material adverse effect on us.

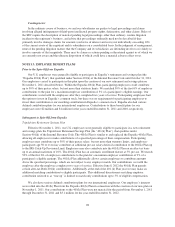

NOTE 13: EMPLOYEE BENEFIT PLANS

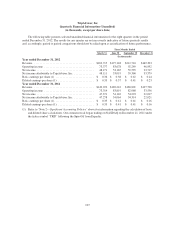

Prior to the Spin-Off from Expedia

Our U.S. employees were generally eligible to participate in Expedia’s retirement and savings plan (the

“Expedia 401(k) Plan”) that qualified under Section 401(k) of the Internal Revenue Code until October 31, 2011.

Our employees ceased to participate in this plan upon the creation of our new retirement and savings plan on

November 1, 2011 described below. Within the Expedia 401(k) Plan, participating employees could contribute

up to 50% of their pretax salary, but not more than statutory limits. We matched 50% of the first 6% of employee

contributions to the plan for a maximum employer contribution of 3% of a participant’s eligible earnings. Our

contributions vested with the employees after they completed two years of service. Participating employees had

the option to invest in Expedia’s common stock, but there was no requirement for participating employees to

invest their contribution or our matching contribution in Expedia’s common stock. Expedia also had various

defined contribution plans for our international employees. Contributions to these benefit plans for our

employees were $2 million and $1 million for the years ended December 31, 2011 and 2010, respectively.

Subsequent to Spin-Off from Expedia

TripAdvisor Retirement Savings Plan

Effective November 1, 2011, our U.S. employees were generally eligible to participate in a new retirement

and savings plan, the TripAdvisor Retirement Savings Plan (the “401(k) Plan”), that qualifies under

Section 401(k) of the Internal Revenue Code. The 401(k) Plan is similar to and replaced the Expedia 401(k) Plan,

allowing all employees to make contributions of a specified percentage of their compensation. Participating

employees may contribute up to 50% of their pretax salary, but not more than statutory limits, and employee-

participants age 50 or over may contribute an additional pre-tax salary deferral contribution to the 401(k) Plan up

to the IRS Catch-Up Provision Limit. Employees may also contribute into the 401(k) Plan on an after-tax basis

up to an annual maximum of 10%. The 401(k) Plan has an automatic enrollment feature at 3% pre-tax. We match

50% of the first 6% of employee contributions to the plan for a maximum employer contribution of 3% of a

participant’s eligible earnings. The 401(k) Plan additionally allows certain employees to contribute amounts

above the specified percentage, which are not subject to any employer match. Our contributions vest with the

employee after the employee completes two years of service. Effective June 8, 2012 the 401(k) Plan permits

certain after-tax Roth 401(k) contributions. Additionally at the end of the 401 (k) Plan year we may make an

additional matching contribution to eligible participants. This additional discretionary matching employer

contribution referred to as “true up” is limited to match only contributions up to 3% of eligible compensation.

We also have various defined contribution plans for our international employees. Our employee’s interests

were rolled into the 401(k) Plan from the Expedia 401(k) Plan in connection with the creation of our new plan on

November 1, 2011. Our contributions to the 401(k) Plan were not material for the period from November 1, 2011

through December 31, 2011 and $3.1 million for the year ended December 31, 2012.

98