Travelers 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

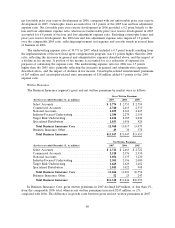

The underwriting expense ratio of 36.8% in 2007 was 1.5 points higher than the comparable 2006

expense ratio, driven by the increase in expenses supporting business growth. The underwriting expense

ratio in 2006 improved by 0.4 points compared with 2005, benefiting from the absence of catastrophe-

related reinstatement premiums and increased business volume. Reinstatement premiums of $33 million

increased the 2005 underwriting expense ratio by 0.4 points.

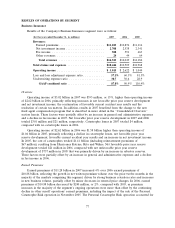

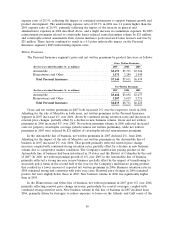

Written Premiums

Financial, Professional & International Insurance gross and net written premiums by market were

as follows:

Gross Written Premiums

(for the year ended December 31, in millions) 2007 2006 2005

Bond & Financial Products ....................... $2,614 $2,657 $2,531

International ................................. 1,423 1,324 1,278

Total Financial, Professional & International Insurance .$4,037 $3,981 $3,809

Net Written Premiums

(for the year ended December 31, in millions) 2007 2006 2005

Bond & Financial Products ....................... $2,228 $2,255 $2,117

International ................................. 1,237 1,138 1,042

Total Financial, Professional & International Insurance .$3,465 $3,393 $3,159

Gross and net written premiums in 2007 increased 1% and 2%, respectively, over 2006. Adjusting

for the sale of Afianzadora Insurgentes, gross and net written premiums increased 3% and 4%,

respectively, over 2006. Net written premiums in the Bond & Financial Products group in 2007

increased 1% over 2006 (adjusted for the sale of Afianzadora Insurgentes), primarily due to increased

construction surety business volume resulting from strong economic conditions in the public works

sector of the construction industry. For Bond and Financial Products (excluding the surety line of

business, for which these are not relevant measures), business retention rates in 2007 increased over

2006. Renewal price changes in 2007 were slightly positive but down from 2006, and new business levels

declined due in part to competitive market conditions. In the International group, net written

premiums in 2007 increased $99 million, or 9%, over 2006, primarily reflecting the favorable impact of

foreign currency exchange rates and strong business volume at Lloyd’s and in Canada. Net written

premium volume in the International group in 2007 also benefited from adjustments to prior year

premium estimates in the Lloyd’s operation. In 2007, business retention rates remained strong, new

business volume increased over 2006, and renewal price changes, which were negative, in the

International group declined slightly from 2006.

The Financial, Professional & International Insurance segment’s gross and net written premiums in

2006 increased 5% and 7%, respectively, over 2005. Growth in net written premium volume in 2006

resulted from strong construction surety volume in Bond & Financial Products, strong price increases

for Southeastern U.S. catastrophe-prone exposures in the Company’s operations at Lloyd’s, strong

business retention rates and new business volume in International, and the absence of catastrophe-

related reinstatement premiums. The elimination of a reporting lag at the Company’s operations at

Lloyd’s resulted in $39 million and $31 million of additional gross and net written premium volume in

2005, respectively. In Bond & Financial Products (excluding the surety line of business, for which these

are not relevant measures), business retention rates in 2006 remained strong and increased over 2005.

Renewal price increases in 2006 also increased over 2005, but new business volume was down slightly

from 2005. For International in 2006, business retention rates increased over 2005, renewal price

changes increased slightly and new business volume was significantly higher than in 2005. Net written

premiums in the Financial, Professional & International Insurance segment for 2005 were reduced by

85