Travelers 2007 Annual Report Download - page 87

Download and view the complete annual report

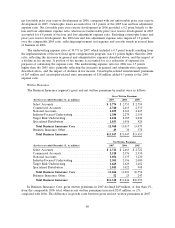

Please find page 87 of the 2007 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In 2005, the Company’s cost of catastrophes, net of reinsurance and including reinstatement

premiums of $121 million and state assessments of $43 million, totaled $2.19 billion, primarily resulting

from Hurricanes Katrina, Rita and Wilma. Reinstatement premiums represent additional premiums

payable to reinsurers to restore coverage limits that have been exhausted as a result of reinsured losses

under certain excess-of-loss reinsurance treaties and are recorded as a reduction of net written and

earned premiums. The majority of catastrophe costs in 2005 were incurred in the Business Insurance

segment ($1.41 billion) and in the Personal Insurance segment ($593 million).

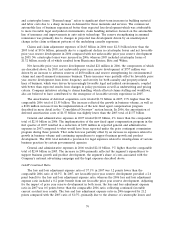

Amortization of Deferred Acquisition Costs

The amortization of deferred acquisition costs totaled $3.71 billion in 2007, $367 million, or 11%,

higher than the comparable total of $3.34 billion in 2006, primarily reflecting a $213 million increase

from the implementation of a new fixed agent compensation program for the majority of the

Company’s agents as described in more detail below. The remaining increase was primarily due to

growth in business volume in 2007. In 2006, the total of $3.34 billion was $87 million, or 3%, higher

than the 2005 total of $3.25 billion, primarily reflecting growth in business volume.

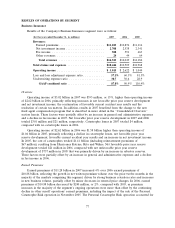

General and Administrative Expenses

General and administrative expenses totaled $3.35 billion in 2007, a decrease of $106 million, or

3%, from the comparable 2006 total of $3.46 billion. The decline primarily reflected the impact of the

Company’s implementation of the new fixed agent compensation program described in the following

paragraph, which was largely offset by expenses related to increased business volume and continued

expenditures to support business growth and product development.

In the first quarter of 2007, the Company discontinued the use of contingent commissions and

implemented a new fixed agent compensation program for all of its personal insurance business. The

Company also offered the majority of its agents conducting commercial insurance business the option

to switch to this new program. The Company’s total payout rate for all agent compensation for 2007

was substantially the same as for 2006; however, the change to the new program created a difference in

the timing of commission expense recognition. The cost of the new program is required to be deferred

and amortized over the related policy period (generally six to twelve months), whereas the cost of the

contingent commission program was not subject to deferred acquisition cost accounting treatment and,

therefore, was expensed as incurred. That timing difference resulted in a benefit to income during the

2007 transition year. The impact of this change in 2007 was to lower reported expenses by $376 million

in the ‘‘General and Administrative Expenses’’ income statement line, and increase reported expenses

by $213 million in the ‘‘Amortization of Deferred Acquisition Costs’’ income statement line, compared

to what would have been reported under the prior contingent commission program.

General and administrative expenses totaled $3.46 billion in 2006, an increase of $229 million, or

7%, over the comparable 2005 total of $3.23 billion. The increase in 2006 was driven by investments

made throughout the Company to support business growth and product development, costs related to

the Company’s national advertising campaign and legal expenses related to investigations of various

business practices by certain governmental agencies (see ‘‘Item 3—Legal Proceedings’’). These factors

were partially offset by the impact of the favorable resolution of certain prior-year state tax matters,

certain tax benefits, the absence of catastrophe-related state assessments and lower premium tax-related

expenses.

Interest Expense

Interest expense of $346 million in 2007 was $22 million higher than the comparable 2006 total of

$324 million. Interest expense in 2006 was $38 million higher than in 2005. The increases in both years

primarily reflected the impact of the Company’s issuance of debt, which is described in more detail in

75