Travelers 2007 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2007 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

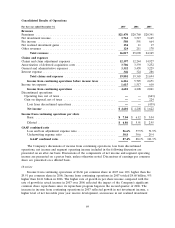

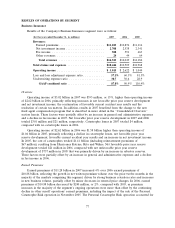

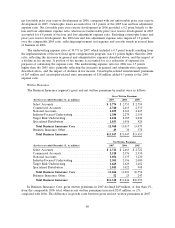

Written Premiums

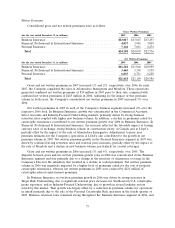

Consolidated gross and net written premiums were as follows:

Gross Written Premiums

(for the year ended December 31, in millions) 2007 2006 2005

Business Insurance ........................................ $13,017 $13,047 $13,453

Financial, Professional & International Insurance .................. 4,037 3,981 3,809

Personal Insurance ........................................ 7,144 7,011 6,474

Total ................................................ $24,198 $24,039 $23,736

Net Written Premiums

(for the year ended December 31, in millions) 2007 2006 2005

Business Insurance ........................................ $11,318 $11,046 $10,999

Financial, Professional & International Insurance .................. 3,465 3,393 3,159

Personal Insurance ........................................ 6,835 6,711 6,228

Total ................................................ $21,618 $21,150 $20,386

Gross and net written premiums in 2007 increased 1% and 2%, respectively, over 2006. In early

2007, the Company completed the sales of Afianzadora Insurgentes and Mendota. These operations

generated combined net written premiums of $74 million in 2007 prior to their sale, compared with

combined net written premiums of $265 million in 2006. Adjusting for the impact of that premium

volume in both years, the Company’s consolidated net written premiums in 2007 increased 3% over

2006.

Net written premiums in 2007 in each of the Company’s business segments increased 2% over the

respective 2006 total. In Business Insurance, growth was concentrated in the Commercial Accounts,

Select Accounts and Industry-Focused Underwriting markets, primarily driven by strong business

retention rates coupled with higher new business volume. In addition, a decline in premiums ceded for

catastrophe reinsurance contributed to net written premium growth over 2006 in Business Insurance. In

Financial, Professional & International Insurance, the increase reflected the favorable impact of foreign

currency rates of exchange, strong business volume in construction surety, in Canada and at Lloyd’s,

partially offset by the impact of the sale of Afianzadora Insurgentes. Adjustments to prior year

premium estimates for the Company’s operations at Lloyd’s also contributed to the growth in net

premium volume in 2007. Net written premium growth in the Personal Insurance segment in 2007 was

driven by continued strong retention rates and renewal price increases, partially offset by the impact of

the sale of Mendota and a decline in new business volume, particularly for coastal coverages.

Gross and net written premiums in 2006 increased 1% and 4%, respectively, over 2005. The

disparity between gross and net written premium growth rates in 2006 was concentrated in the Business

Insurance segment and was primarily due to a change in the structure of reinsurance coverage in the

Company’s Discover Re subsidiary that resulted in a decline in ceded premiums. Net written premium

volume in 2006 was negatively impacted by a higher level of premiums ceded for the cost of property

catastrophe reinsurance, whereas net written premiums in 2005 were reduced by $121 million of

catastrophe-related reinstatement premiums.

In Business Insurance, net written premium growth in 2006 was driven by strong increases in

Target Risk Underwriting, due to significant renewal price increases for Southeastern U.S. catastrophe-

prone exposures, and in Industry-Focused Underwriting, due to growth in several industry sectors

served by this market. That growth was largely offset by a reduction in premium volume for operations

in runoff primarily due to the sale of the Personal Catastrophe Risk operation in the fourth quarter of

2005. Business retention rates remained strong throughout the Business Insurance segment in 2006, and

73