Travelers 2007 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2007 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

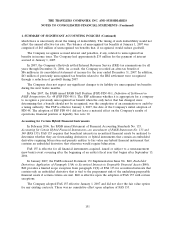

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The consolidated financial statements include the accounts of The Travelers Companies, Inc.

(together with its subsidiaries, the Company). The preparation of the consolidated financial statements

in conformity with U.S. generally accepted accounting principles (GAAP) requires management to

make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure

of contingent assets and liabilities at the date of the consolidated financial statements and the reported

amounts of revenues and claims and expenses during the reporting period. Actual results could differ

from those estimates. Certain reclassifications have been made to the 2006 and 2005 financial

statements to conform to the 2007 presentation. This includes a reclassification of certain

contractholder receivables and payables in the consolidated balance sheet, which had previously been

reported on a net basis, to a gross basis, consistent with the Company’s accounting policy. All material

intercompany transactions and balances have been eliminated.

Effective February 26, 2007, The St. Paul Travelers Companies, Inc. amended its articles of

incorporation to change its name to The Travelers Companies, Inc. and, effective the same day,

amended its bylaws to reflect the name change.

Adoption of New Accounting Standards

Accounting for Uncertainty in Income Taxes

In July 2006, the Financial Accounting Standards Board (FASB) issued Interpretation No. 48,

Accounting for Uncertainty in Income Taxes—an Interpretation of FASB Statement No. 109 (FIN 48).

FIN 48 is intended to clarify the accounting for uncertainty in income taxes recognized in a company’s

financial statements and prescribes the recognition and measurement of a tax position taken or

expected to be taken in a tax return. FIN 48 also provides guidance on de-recognition, classification,

interest and penalties, accounting in interim periods, disclosure and transition.

Under FIN 48, evaluation of a tax position is a two-step process. The first step is to determine

whether it is more-likely-than-not that a tax position will be sustained upon examination, including the

resolution of any related appeals or litigation based on the technical merits of that position. The second

step is to measure a tax position that meets the more-likely-than-not threshold to determine the

amount of benefit to be recognized in the financial statements. A tax position that meets the

more-likely-than-not recognition threshold shall initially and subsequently be measured as the largest

amount of tax benefit that has a greater than 50 percent likelihood of being realized upon ultimate

settlement with a taxing authority that has full knowledge of all relevant information.

Tax positions that previously failed to meet the more-likely-than-not recognition threshold should

be recognized in the first subsequent period in which the threshold is met. Previously recognized tax

positions that no longer meet the more-likely-than-not criteria should be de-recognized in the first

subsequent financial reporting period in which the threshold is no longer met.

The adoption of FIN 48 effective January 1, 2007 did not have a material effect on the Company’s

results of operations, financial position or liquidity.

The total amount of unrecognized tax benefits as of January 1, 2007 was $339 million. Included in

that balance were $101 million of unrecognized tax benefits that, if recognized, would affect the annual

effective tax rate and $175 million of tax positions for which the ultimate deductibility is certain, but for

150