Travelers 2007 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2007 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LIQUIDITY AND CAPITAL RESOURCES

Liquidity is a measure of a company’s ability to generate sufficient cash flows to meet the short-

and long-term cash requirements of its business operations. The liquidity requirements of the

Company’s business have been met primarily by funds generated from operations, asset maturities and

income received on investments. Cash provided from these sources is used primarily for claims and

claim adjustment expense payments and operating expenses. The timing and amount of catastrophe

claims are inherently unpredictable. Such claims increase liquidity requirements. The timing and

amount of reinsurance recoveries may be affected by reinsurer solvency and reinsurance coverage

disputes. Additionally, the variability of asbestos-related claim payments, as well as the volatility of

potential judgments and settlements arising out of litigation, may also result in increased liquidity

requirements. It is the opinion of the Company’s management that the Company’s future liquidity

needs will be adequately met from all of the above sources. The Company also maintains liquidity at

the holding company level. At December 31, 2007, total cash, short-term invested assets and other

readily marketable securities aggregating $1.62 billion were held at the holding company. The assets

held at the holding company, combined with other sources of funds available, primarily additional

dividends from operating subsidiaries, are sufficient to meet the Company’s current liquidity

requirements. These liquidity requirements primarily include shareholder dividends and debt service.

The Company also has the ability to issue securities under its shelf registration statement with the

Securities and Exchange Commission and has access to liquidity through its $1 billion line of credit.

Operating Activities

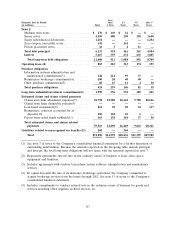

Net cash flows provided by operating activities of continuing operations totaled $5.29 billion,

$4.77 billion and $3.59 billion in 2007, 2006 and 2005, respectively. Cash flows in each of 2007 and

2006, as compared to the preceding year, reflected higher levels of collected premiums and net

investment income, lower claim payments on catastrophe losses, as well as lower runoff claim payments.

Cash flows from operations in 2007 and 2006 benefited from significant collections on reinsurance

recoverables in both years, including those related to 2005 hurricane losses, operations in runoff

(primarily Gulf) and various commutation agreements. These factors were partially offset by an

increase in tax payments resulting from higher profitability, expenses related to increased business

volume and continued expenditures to support business growth and product development, and higher

interest payments. Cash flows in 2005 reflected an increase in loss and loss adjustment expense

payments primarily related to the catastrophe losses incurred during 2005 and 2004, and an increase in

tax payments resulting from higher profitability. The Company utilized $11 million, $11 million and

$2.00 billion of net operating loss (NOL) carryforwards during 2007, 2006 and 2005, respectively,

thereby reducing current regular tax payments by $4 million, $4 million and $698 million, respectively.

Net cash flows provided by operating activities for all three years were negatively impacted by

payments for asbestos and environmental liabilities, as well as by payments for claims related to the

Company’s runoff operations.

Investing Activities

Net cash flows used in investing activities of continuing operations totaled $2.53 billion,

$3.06 billion and $5.44 billion in 2007, 2006 and 2005, respectively. Fixed maturity securities accounted

for the majority of investment purchases in all three years. As discussed in more detail in ‘‘Part I—

Item 3, Legal Proceedings,’’ in 2007, the Company announced that it had entered into a settlement

agreement, subject to contingencies, to resolve fully all current and future asbestos-related coverage

claims relating to ACandS, Inc. As a result, the Company has placed $449 million into escrow. Upon

fulfillment of all settlement contingencies, including final court approval of a plan of reorganization for

ACandS and the issuance of the injunctions described in ‘‘Part I—Item 3, Legal Proceedings,’’ those

105