Travelers 2007 Annual Report Download - page 153

Download and view the complete annual report

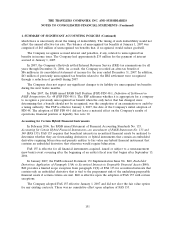

Please find page 153 of the 2007 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.underwriting results are forward looking, and the Company may make forward-looking statements

about its results of operations (including, among others, premium volume, net and operating income,

investment income, return on equity and combined ratio), and financial position (including, among

others, invested assets and liquidity); the sufficiency of asbestos and other reserves (including, among

others, asbestos claim payment patterns); the cost and availability of reinsurance coverage; catastrophe

losses; investment performance; market conditions; and strategic initiatives. Such statements are subject

to risks and uncertainties, many of which are difficult to predict and generally beyond the Company’s

control, that could cause actual results to differ materially from those expressed in, or implied or

projected by, the forward-looking information and statements.

For a discussion of some of the factors that could cause actual results to differ, see ‘‘Item 1A—

Risk Factors’’. and ‘‘Item 7—Management’s Discussion and Analysis of Financial Condition and Results

of Operations—Critical Accounting Estimates.’’

The Company’s forward-looking statements speak only as of the date of this report or as of the

date they are made, and the Company undertakes no obligation to update its forward-looking

statements.

Item 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

MARKET RISK

Market risk is the risk of loss arising from adverse changes in market rates and prices, such as

interest rates, foreign currency exchange rates and other relevant market rate or price changes. Market

risk is directly influenced by the volatility and liquidity in the markets in which the related underlying

assets are traded. The following is a discussion of the Company’s primary market risk exposures and

how those exposures are managed as of December 31, 2007. The Company’s market risk sensitive

instruments, including derivatives, are primarily entered into for purposes other than trading.

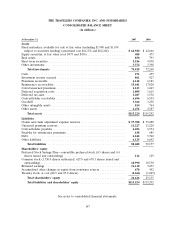

The carrying value of the Company’s investment portfolio as of December 31, 2007 and 2006 was

$74.82 billion and $72.27 billion, respectively, of which 87% was invested in fixed maturity securities at

both dates. At December 31, 2007 and 2006, approximately 6.5% and 6.0%, respectively, of the

Company’s invested assets were denominated in foreign currencies. The Company’s exposure to equity

price risk is not significant. The Company has no direct commodity risk.

The Company’s fixed maturity investment portfolio at December 31, 2007 included asset-backed

securities collateralized by sub-prime mortgages and collateralized mortgage obligations backed by

alternative documentation mortgages with a collective market value of $286 million (comprising

approximately 0.4% of the Company’s total fixed maturity investments). The Company defines

sub-prime mortgage-backed securities as investments which contain loans to borrowers that exhibit one

or more of the following characteristics: low FICO scores, above-prime interest rates, high loan-to-value

ratios, high debt-to-income ratios, low loan documentation (e.g., limited or no verification of income

and assets), or other characteristics that are inconsistent with conventional underwriting standards

employed by government-sponsored mortgage entities. Alternative documentation mortgages are

mortgage loans with low loan documentation as described above. The average credit rating on all of

these securities and obligations held by the Company was ‘‘Aaa’’ at December 31, 2007. No securities in

the residential mortgage portfolio were downgraded in 2007.

The Company’s fixed maturity investment portfolio at December 31, 2007 included securities issued

by numerous municipalities with a total carrying value of $38.82 billion. Approximately $14.10 billion,

or 36%, of the securities were enhanced by third-party insurance for the payment of principal and

interest in the event of an issuer default. Such insurance generally results in a rating of ‘‘Aaa’’ being

assigned by independent ratings agencies to those securities. The downgrade of credit ratings of

insurers of these securities could result in a corresponding downgrade in the ratings of the securities

141