Travelers 2007 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2007 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Personal Insurance

The Personal Insurance segment writes virtually all types of property and casualty insurance

covering personal risks. The primary coverages in Personal Insurance are automobile and homeowners

insurance sold to individuals. These products are distributed through independent agents, sponsoring

organizations such as employee and affinity groups, joint marketing arrangements with other insurers

and direct marketing.

Automobile policies provide coverage for liability to others for both bodily injury and property

damage, and for physical damage to an insured’s own vehicle from collision and various other perils. In

addition, many states require policies to provide first-party personal injury protection, frequently

referred to as no-fault coverage.

Homeowners policies are available for dwellings, condominiums, mobile homes and rental property

contents. Protection against losses to dwellings and contents from a wide variety of perils is included in

these policies, as well as coverage for liability arising from ownership or occupancy.

In April 2007, the Company completed the sale of its subsidiary, Mendota Insurance Company,

and its wholly-owned subsidiaries, Mendakota Insurance Company and Mendota Insurance Agency, Inc.

These subsidiaries primarily offered nonstandard automobile coverage and accounted for approximately

$49 million, $187 million and $137 million of net written premiums for the years ended December 31,

2007, 2006 and 2005, respectively. The sale was not material to the Company’s results of operations or

financial position.

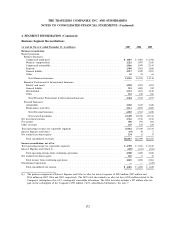

2. SEGMENT INFORMATION

The Company is organized into three reportable business segments: Business Insurance; Financial,

Professional & International Insurance; and Personal Insurance. The accounting policies used to

generate the following segment data are the same as those described in the Summary of Significant

Accounting Policies in note 1.

The Company allocates invested assets and the related net investment income to its reportable

business segments. Pretax net investment income is allocated based upon an investable funds concept,

which takes into account liabilities (net of non-invested assets) and appropriate capital considerations

for each segment. For investable funds, a benchmark investment yield is developed that reflects the

estimated duration of the loss reserves’ future cash flows, the interest rate environment at the time the

losses were incurred and A+ rated corporate debt instrument yields. For capital, a benchmark

investment yield is developed that reflects the average yield on the total investment portfolio. The

benchmark investment yields are applied to each segment’s investable funds and capital, respectively, to

produce a total notional investment income by segment. The Company’s actual net investment income

is allocated to each segment in proportion to the respective segment’s notional investment income to

total notional investment income.

The cost of the Company’s catastrophe treaty program is included in the Company’s ceded

premiums and is allocated among reportable business segments based on an estimate of actual market

reinsurance pricing using expected losses calculated by the Company’s catastrophe model, adjusted for

any experience adjustments. For Hurricane Katrina in 2005, the initial allocation of reinsurance

recoverables to the segments was based upon the best estimate of segment incurred losses.

169