Travelers 2007 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2007 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280

|

|

emphasis on short-tail insurance lines. The Company underwrites through five principal lines of

business at Lloyd’s: aviation, marine, global property, accident and special risks, and power and utilities.

PERSONAL INSURANCE

Personal Insurance writes a broad range of property and casualty insurance covering personal risks.

The primary coverages in Personal Insurance are automobile and homeowners insurance sold to

individuals. These products are distributed through independent agents, sponsoring organizations such

as employee and affinity groups, joint marketing arrangements with other insurers, and direct

marketing.

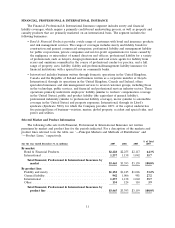

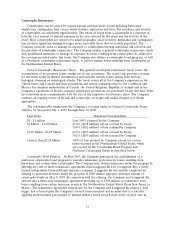

Selected Product and Distribution Channel Information

The following table sets forth net written premiums for Personal Insurance by product line for the

periods indicated. For a description of the product lines referred to in the following table, see

‘‘—Product Lines.’’ In addition, see ‘‘—Principal Markets and Methods of Distribution’’ for a discussion

of distribution channels for Personal Insurance’s product lines.

% of Total

(for the year ended December 31, in millions) 2007 2006 2005 2007

By product line:

Personal automobile ................................ $3,628 $3,692 $3,477 53.1%

Homeowners and other ............................. 3,207 3,019 2,751 46.9

Total Personal Insurance ........................... $6,835 $6,711 $6,228 100.0%

In April 2007, the Company completed the sale of its subsidiary, Mendota Insurance Company,

and its wholly-owned subsidiaries, Mendakota Insurance Company and Mendota Insurance Agency, Inc.

These subsidiaries primarily offered nonstandard automobile coverage and accounted for $49 million,

$187 million and $137 million of net written premiums in the years ended December 31, 2007, 2006

and 2005, respectively. The sale was not material to the Company’s results of operations or financial

position.

Principal Markets and Methods of Distribution

Personal Insurance products are distributed primarily through approximately 8,400 independent

agents located throughout the United States, supported by personnel in eleven marketing regions, three

single state companies and six service centers. In selecting new independent agencies to distribute its

products, Personal Insurance considers, among other matters, each agency’s profitability, financial

stability, staff experience and strategic fit with Personal Insurance’s operating and marketing plans.

Once an agency is appointed, Personal Insurance carefully monitors its performance. While the

principal markets for Personal Insurance’s insurance products are in states along the East Coast, in the

South and Texas, Personal Insurance continues to expand its geographic presence across the United

States.

Personal Insurance operates single state companies in Massachusetts, New Jersey and Florida with

products marketed primarily through independent agents. These states represented approximately 17%

of Personal Insurance direct written premiums in 2007. The companies were established to manage

complex markets in Massachusetts and New Jersey and property catastrophe exposure in Florida. The

companies in Massachusetts and New Jersey have dedicated resources in underwriting, claim, finance,

legal and service functions. The company in Florida has dedicated resources for claim, finance and

legal functions.

15