Travelers 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280

|

|

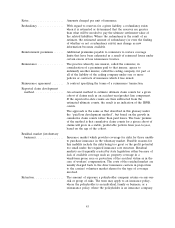

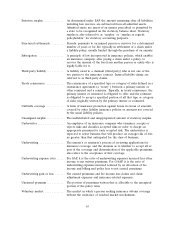

Rates .................... Amounts charged per unit of insurance.

Redundancy ............... With regard to reserves for a given liability, a redundancy exists

when it is estimated or determined that the reserves are greater

than what will be needed to pay the ultimate settlement value of

the related liabilities. Where the redundancy is the result of an

estimate, the estimated amount of redundancy (or even the finding

of whether or not a redundancy exists) may change as new

information becomes available.

Reinstatement premiums ...... Additional premiums payable to reinsurers to restore coverage

limits that have been exhausted as a result of reinsured losses under

certain excess of loss reinsurance treaties.

Reinsurance ............... The practice whereby one insurer, called the reinsurer, in

consideration of a premium paid to that insurer, agrees to

indemnify another insurer, called the ceding company, for part or

all of the liability of the ceding company under one or more

policies or contracts of insurance which it has issued.

Reinsurance agreement ....... A contract specifying the terms of a reinsurance transaction.

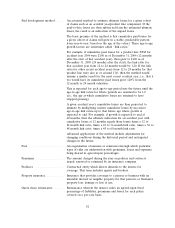

Reported claim development

method ................. An actuarial method to estimate ultimate claim counts for a given

cohort of claims such as an accident year/product line component.

If the reported-to-date counts are then subtracted from the

estimated ultimate counts, the result is an indication of the IBNR

counts.

The approach is the same as that described in this glossary under

the ‘‘paid loss development method’’, but based on the growth in

cumulative claim counts rather than paid losses. The basic premise

of the method is that cumulative claim counts for a given cohort of

claims will grow in a stable, predictable pattern from year-to-year,

based on the age of the cohort.

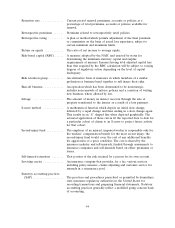

Residual market (involuntary

business) ................ Insurance market which provides coverage for risks for those unable

to purchase insurance in the voluntary market. Possible reasons for

this inability include the risks being too great or the profit potential

too small under the required insurance rate structure. Residual

markets are frequently created by state legislation either because of

lack of available coverage such as: property coverage in a

windstorm prone area or protection of the accident victim as in the

case of workers’ compensation. The costs of the residual market are

usually charged back to the direct insurance carriers in proportion

to the carriers’ voluntary market shares for the type of coverage

involved.

Retention ................. The amount of exposure a policyholder company retains on any one

risk or group of risks. The term may apply to an insurance policy,

where the policyholder is an individual, family or business, or a

reinsurance policy, where the policyholder is an insurance company.

43