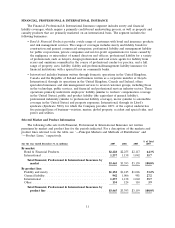

Travelers 2007 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2007 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In March 2007, the Company completed the sale of its Mexican surety subsidiary, Afianzadora

Insurgentes, S.A. de C.V., which accounted for $25 million, $78 million and $78 million of net written

premiums for the years ended December 31, 2007, 2006 and 2005, respectively. The impact of this

transaction was not material to the Company’s results of operations or financial position.

Principal Markets and Methods of Distribution

Within the Financial, Professional & International Insurance segment, Bond & Financial Products

distributes the majority of its products in the United States through approximately 6,400 of the same

independent agencies and brokers that distribute the Business Insurance segment’s products. These

brokers and independent agencies are located throughout the United States. Bond & Financial

Products, in conjunction with the Business Insurance segment, continues to make significant

investments in enhanced technology utilizing internet-based applications to provide real-time interface

capabilities with its independent agencies and brokers. Bond & Financial Products builds relationships

with well-established, independent insurance agencies and brokers. In selecting new independent

agencies and brokers to distribute its products, Bond & Financial Products considers, among other

matters, each agency’s or broker’s profitability, financial stability, staff experience and strategic fit with

its operating and marketing plans. Once an agency or broker is appointed, its ongoing performance is

closely monitored. In addition, Bond & Financial Products sells its surety products through independent

agents using subsidiaries in Canada and the United Kingdom.

The International market distributes its products through brokers in the domestic markets of each

of the three countries in which it operates, the United Kingdom, Canada and the Republic of Ireland.

It also writes business at Lloyd’s, where its products are distributed through Lloyd’s wholesale and

retail brokers. By virtue of Lloyd’s worldwide licenses, Financial, Professional & International Insurance

has access to international markets across the world.

Pricing and Underwriting

Pricing levels for Financial, Professional & International Insurance property and casualty insurance

products are generally developed based upon an estimation of expected losses, the expenses of

producing, issuing and servicing business and managing claims, and a reasonable allowance for profit.

Financial, Professional & International Insurance has a disciplined approach to underwriting and risk

management that emphasizes profitable growth rather than premium volume or market share.

Financial, Professional & International Insurance has developed an underwriting and pricing

methodology that incorporates dedicated underwriting, claims, engineering, actuarial and product

development disciplines. This approach is designed to maintain high quality underwriting and pricing

discipline, based on an in-depth knowledge of the specific account or industry issues. The underwriters

use proprietary data gathered and analyzed over many years to assess and evaluate risks prior to

quotation, and then use proprietary forms to tailor insurance coverage to insureds within the target

markets. This methodology enables Financial, Professional & International Insurance to streamline its

risk selection process and develop pricing parameters that will not compromise its underwriting

integrity.

The Company continually monitors its exposure to natural and manmade peril catastrophic losses

and attempts to manage such exposure. The Company uses various analyses and methods, including

sophisticated computer modeling techniques, to analyze underwriting risks of business in hurricane-

prone, earthquake-prone and target risk areas. The Company relies upon this analysis to make

underwriting decisions designed to manage its exposure on catastrophe-exposed business. The Company

also utilizes reinsurance to manage its aggregate exposures to catastrophes. See ‘‘—Reinsurance.’’

12