Travelers 2007 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2007 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• On June 18, 2007, A.M. Best affirmed all ratings of the Company. The outlook was stable.

• On June 25, 2007, S&P assigned its interactive Lloyd’s Syndicate Assessment (LSA) of ‘‘3’’ to

The St. Paul Travelers Syndicate Management—Syndicate 5000. The outlook was stable.

• On October 2, 2007, A.M. Best upgraded the financial strength ratings to ‘‘A+’’ from ‘‘A’’ and

issuer credit ratings to ‘‘aa’’ from ‘‘a’’ for Northland Insurance Company, Northfield Insurance

Company, Northland Casualty Company, American Equity Specialty Insurance Company and

American Equity Insurance Company, formerly members of the Northland Pool. In addition,

Fidelity and Guaranty Insurance Underwriters, Inc., St. Paul Guardian Insurance Company and

St. Paul Mercury Insurance Company financial strength ratings of ‘‘A+’’ and issuer credit ratings

of ‘‘aa’’ were affirmed. The outlook for all ratings was stable. Concurrently, A.M. Best

withdrew the financial strength rating of ‘‘A’’ and issuer credit rating of ‘‘a’’ and assigned a

category NR-5 (Not Formally Followed) to the Former Northland Pool. A.M. Best also withdrew

the financial strength rating of ‘‘A’’ and the issuer credit rating of ‘‘a’’ of Discover

Reinsurance Company in connection with the merger of Discover Reinsurance Company into

Travelers Indemnity Company.

• On October 17, 2007, A.M. Best affirmed the financial strength rating of ‘‘A’’ and issuer credit

rating of ‘‘a+’’ of St. Paul Travelers Insurance Company Limited. The ratings outlook remained

stable.

• On November 20, 2007, Moody’s announced that it was reviewing its ratings of the Company for

a possible upgrade.

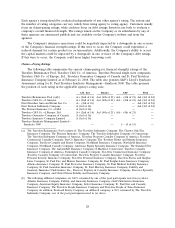

INVESTMENT OPERATIONS

A significant majority of funds available for investment are deployed in a widely diversified

portfolio of high quality, liquid intermediate-term taxable U.S. government, corporate and mortgage

backed bonds and tax-exempt U.S. municipal bonds. The Company closely monitors the duration of its

fixed maturity investments, and investment purchases and sales are executed with the objective of

having adequate funds available to satisfy the Company’s insurance and debt obligations. The

Company’s management of the duration of the fixed income investment portfolio generally produces a

duration that modestly exceeds the estimated duration of the Company’s net insurance liabilities.

The primary goals of the Company’s asset liability management process are to satisfy the insurance

liabilities, manage the interest rate risk embedded in those insurance liabilities and maintain sufficient

liquidity to cover fluctuations in projected liability cash flows. Generally, the expected principal and

interest payments produced by the Company’s fixed income portfolio adequately fund the estimated

runoff of the Company’s insurance reserves. Although this is not an exact cash flow match in each

period, the substantial degree by which the market value of the fixed income portfolio exceeds the

present value of the net insurance liabilities, plus the positive cash flow from newly sold policies and

the large amount of high quality liquid bonds provides assurance of the Company’s ability to fund the

payment of claims without having to sell illiquid assets or access credit facilities.

The Company also invests much smaller amounts in equity securities, venture capital investments

(through direct ownership and limited partnerships), private equity limited partnerships, joint ventures,

other limited partnerships, mortgage loans and trading securities. These investment classes have the

potential for higher returns but also involve varying degrees of risk, including less stable rates of return

and less liquidity.

See note 3 of notes to the Company’s consolidated financial statements for additional information

regarding the Company’s investment portfolio.

30