Travelers 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.insurance contract (e.g., claims made versus occurrence), claim complexity, the volume of claims, the

potential severity of individual claims, the determination of the occurrence date for a claim, and

reporting lags (the time between the occurrence of the insured event and when it is actually reported

to the insurer). Informed judgment is applied throughout the process.

The Company derives estimates for unreported claims and development on reported claims

principally from actuarial analyses of historical patterns of loss development by accident year for each

type of exposure and business unit. Similarly, the Company derives estimates of unpaid loss adjustment

expenses principally from actuarial analyses of historical development patterns of the relationship of

loss adjustment expenses to losses for each line of business and type of exposure. For a description of

the Company’s reserving methods for asbestos and environmental claims, see ‘‘Item 7—Management’s

Discussion and Analysis of Financial Condition and Results of Operations—Asbestos Claims and

Litigation,’’ and ‘‘—Environmental Claims and Litigation.’’

Discounting

Included in the claims and claim adjustment expense reserves in the consolidated balance sheet are

certain reserves discounted to the present value of estimated future payments. The liabilities for losses

for most long-term disability payments under workers’ compensation insurance and workers’

compensation excess insurance, which totaled $2.09 billion and $1.98 billion at December 31, 2007 and

2006, respectively, were discounted using a rate of 5% at December 31, 2007 and 2006. Reserves for

certain assumed reinsurance business were discounted using a rate of 7% at both December 31, 2007

and 2006, and totaled $33 million and $37 million at December 31, 2007 and 2006, respectively.

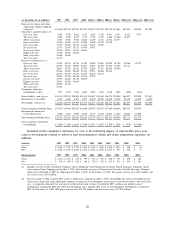

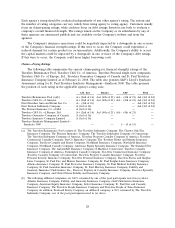

Claims and Claim Adjustment Expense Development Table

The table that follows sets forth the year-end reserves from 1997 through 2007 and the subsequent

changes in those reserves, presented on a historical basis. The original estimates, cumulative amounts

paid and reestimated reserves in the table for the years 1997 through 2003 have not been restated to

reflect the acquisition of SPC in 2004. The table includes SPC reserves beginning at December 31,

2004.

In addition, the original estimates, cumulative amounts paid and reestimated reserves in the table

for the years 1997 to 2000 have not been restated to reflect the acquisition of Northland and

Commercial Guaranty Casualty. Beginning in 2001, the table includes the reserve activity of Northland

and Commercial Guaranty Casualty. The data in the table is presented in accordance with reporting

requirements of the Securities and Exchange Commission (SEC). Care must be taken to avoid

misinterpretation by those unfamiliar with this information or familiar with other data commonly

reported by the insurance industry. The data in the table is not accident year data, but rather a display

of 1997 to 2007 year-end reserves and the subsequent changes in those reserves.

For instance, the ‘‘cumulative deficiency (redundancy)’’ shown in the table for each year represents

the aggregate amount by which original estimates of reserves as of that year-end have changed in

subsequent years. Accordingly, the cumulative deficiency for a year relates only to reserves at that

year-end and those amounts are not additive. Expressed another way, if the original reserves at the end

of 1997 included $4 million for a loss that is finally paid in 2005 for $5 million, the $1 million

deficiency (the excess of the actual payment of $5 million over the original estimate of $4 million)

would be included in the cumulative deficiencies in each of the years 1997 to 2004 shown in the

accompanying table.

Various factors may distort the re-estimated reserves and cumulative deficiency or redundancy

shown in the table. For example, a substantial portion of the cumulative deficiencies shown in the table

arise from claims on policies written prior to the mid-1980s involving liability exposures such as

asbestos and environmental claims. In the post-1984 period, the Company has developed more stringent

24