Travelers 2007 Annual Report Download - page 91

Download and view the complete annual report

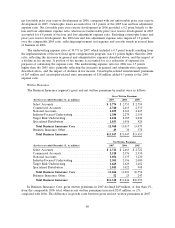

Please find page 91 of the 2007 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and catastrophe losses. ‘‘Demand surge’’ refers to significant short-term increases in building material

and labor costs due to a sharp increase in demand for those materials and services. The commercial

automobile line of business experienced better than expected loss development which was attributable

to more favorable legal and judicial environments, claim handling initiatives focused on the automobile

line of insurance and improvements in auto safety technology. The reserve strengthening in assumed

reinsurance was primarily due to changes in projected loss development driven by an unanticipated

change in the claim settlement patterns of the underlying casualty exposures.

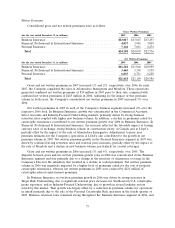

Claims and claim adjustment expenses of $6.85 billion in 2006 were $2.51 billion lower than the

2005 total of $9.36 billion, primarily due to a significant decline in catastrophe losses and net favorable

prior year reserve development in 2006 compared with net unfavorable prior year reserve development

in 2005. No catastrophe losses were incurred in 2006, whereas 2005 included catastrophe losses of

$1.32 billion, nearly all of which resulted from Hurricanes Katrina, Rita and Wilma.

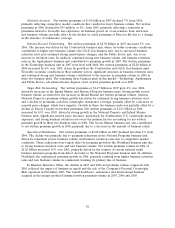

Net favorable prior year reserve development totaled $21 million in 2006, the components of which

are described above. In 2005, net unfavorable prior year reserve development of $757 million was

driven by an increase to asbestos reserves of $830 million and reserve strengthening for environmental

claims and runoff assumed reinsurance business. Those increases were partially offset by favorable prior

year reserve development from lower frequency and severity for both casualty and property-related

lines of business, which were driven by increasingly favorable legal and judicial environments, coupled

with better than expected results from changes in policy provisions as well as underwriting and pricing

criteria. Company initiatives relating to claims handling, which affected claims staffing and workflows,

also are believed to have contributed to the emergence of favorable severity experience in 2005.

The amortization of deferred acquisition costs totaled $1.74 billion in 2007, 13% higher than the

comparable 2006 total of $1.55 billion. The increase reflected the growth in business volume, as well as

a $108 million increase from the implementation of the new fixed agent compensation program

described in more detail in the ‘‘Consolidated Overview’’ section herein. In 2006, the amortization of

deferred amortization costs of $1.55 billion was slightly lower than the 2005 total of $1.57 billion.

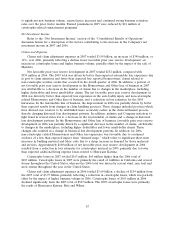

General and administrative expenses in 2007 totaled $2.03 billion, 4% lower than the comparable

total of $2.10 billion in 2006. The implementation of the new fixed agent compensation program in the

first quarter of 2007 resulted in a reduction of $189 million in reported general and administrative

expenses in 2007 compared to what would have been reported under the prior contingent commission

program during those periods. That reduction was partially offset by an increase in expenses related to

growth in business volume and continuing expenditures to support business growth and product

development. The 2006 total included a provision for legal expenses related to investigations of various

business practices by certain governmental agencies.

General and administrative expenses in 2006 totaled $2.10 billion, 3% higher than the comparable

total of $2.04 billion in 2005. The increase in 2006 primarily reflected the segment’s expenditures to

support business growth and product development, the segment’s share of costs associated with the

Company’s national advertising campaign and the legal expenses described above.

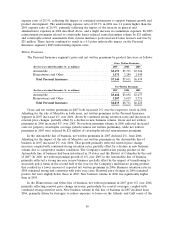

GAAP Combined Ratio

The loss and loss adjustment expense ratio of 57.1% in 2007 was 3.2 points lower than the

comparable 2006 ratio of 60.3%. In 2007, net favorable prior year reserve development provided a 2.6

point benefit to the loss and loss adjustment expense ratio, whereas the 2006 loss and loss adjustment

expense ratio included a 0.2 point benefit from net favorable prior year reserve development. Adjusting

for the impact of prior year reserve development in both years, the loss and loss adjustment expense

ratio in 2007 was 0.8 points better than the comparable 2006 ratio, reflecting continued favorable

current accident year results. The loss and loss adjustment expense ratio in 2006 improved by 21.2

points compared with the 2005 ratio of 81.5%, primarily due to the absence of catastrophe losses and

79