Travelers 2007 Annual Report Download - page 88

Download and view the complete annual report

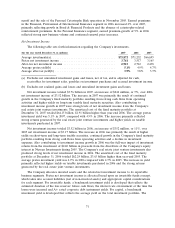

Please find page 88 of the 2007 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the ‘‘Liquidity and Capital Resources’’ section herein. Proceeds from a substantial portion of debt

issuances in both 2007 and 2006 were used to fund the redemption and maturity of certain of the

Company’s indebtedness.

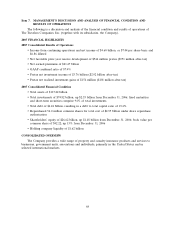

Effective Tax Rate

The Company’s effective tax rate on income from continuing operations was 26.0%, 26.5% and

22.8% in 2007, 2006 and 2005, respectively. The decline in 2007 compared with 2006 reflected an

increase in non-taxable investment income. The increase in 2006 over 2005 primarily reflected a higher

level of pretax income in 2006 due to improved underwriting performance.

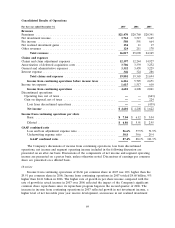

GAAP Combined Ratios

The consolidated loss and loss adjustment expense ratio of 56.6% in 2007 was 0.9 points lower

than the comparable 2006 loss and loss adjustment expense ratio of 57.5%. The 2007 and 2006 loss and

loss adjustment expense ratios included benefits of 2.5 points and 1.9 points, respectively, from net

favorable prior year reserve development. Catastrophe losses accounted for 0.7 points and 0.5 points of

the 2007 and 2006 loss and loss adjustment expense ratios. Excluding catastrophe losses and prior year

reserve development, the 2007 loss and loss adjustment expense ratio improved by 0.5 points compared

with the comparable 2006 ratio, reflecting continuing improvement in current accident year results in

several lines of business. The underwriting expense ratio of 30.8% in 2007 was 0.2 points higher than

the comparable 2006 underwriting expense ratio of 30.6%. The implementation of the new fixed agent

compensation program described above provided a benefit of 0.8 points to the expense ratios in 2007,

which was more than offset by the increases in expenses discussed above.

The consolidated loss and loss adjustment expense ratio of 57.5% in 2006 improved by 14.4 points

compared with 2005, primarily reflecting the decline in catastrophe losses. Catastrophe losses accounted

for 0.5 points of the 2006 loss and loss adjustment expense ratio, compared with a 10.3 point impact in

2005. The 2006 loss and loss adjustment expense ratio included a 1.9 point impact from net favorable

prior year reserve development, whereas the 2005 loss and loss adjustment expense ratio included a 1.6

point impact from net unfavorable prior year reserve development. The 2006 loss and loss adjustment

expense ratio excluding catastrophe losses and prior year reserve development improved over the 2005

ratio on the same basis, reflecting improvement in frequency and severity trends in several lines of

business. The underwriting expense ratio for 2006 was 1.2 points higher than the underwriting expense

ratio in 2005. The changes primarily reflect the impact of the increase in general and administrative

expenses described previously. In addition, the 2006 ratio was negatively impacted by a decline in

National Accounts’ fee income, a portion of which is accounted for as a reduction of expenses for

purposes of calculating the expense ratio. The underwriting expense ratio in 2005 also included a 0.4

point impact from reinstatement premiums and state assessments.

Discontinued Operations

In March 2005, the Company and Nuveen Investments jointly announced that the Company would

implement a program to divest its 78% equity interest in Nuveen Investments, which constituted the

Company’s Asset Management segment and was acquired as part of the merger on April 1, 2004. The

divestiture was completed through a series of transactions in the second and third quarters of 2005,

resulting in net pretax cash proceeds of $2.40 billion.

The Company recorded a net operating loss from discontinued operations of $663 million in 2005,

consisting primarily of $710 million of tax expense due to the difference between the tax basis and the

GAAP carrying value of the Company’s investment in Nuveen Investments, partially offset by the

Company’s share of Nuveen Investments’ net income prior to divestiture. The Company recorded a

pretax gain on disposal of $345 million ($224 million after-tax) in 2005.

76