Travelers 2007 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2007 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280

|

|

Kingdom, a reinsurer is permitted to transfer a reinsurance arrangement to another reinsurer, which

may be less creditworthy, without a counterparty’s consent, provided that the transfer has been

approved by the applicable regulatory and/or court authority.

The Company’s reinsurance recoverables totaled $15.64 billion at December 31, 2007, a decline of

$2.18 billion from year-end 2006, primarily reflecting significant collections on reinsurance recoverables,

including those related to prior year hurricane losses, operations in runoff (primarily Gulf) and various

commutation agreements.

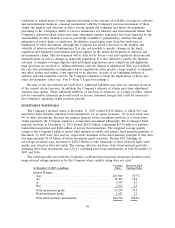

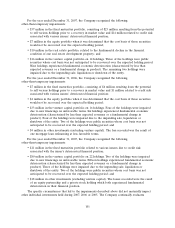

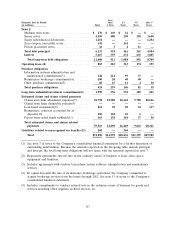

The following presents the Company’s top five reinsurer groups, by reinsurance recoverables at

December 31, 2007 (in millions). Also included is the A.M. Best rating of each reinsurer group at

February 21, 2007:

Reinsurance

Reinsurer Group Recoverables A.M. Best Rating of Group’s Predominant Reinsurer

Swiss Re Group ...................... $1,266 A+ second highest of 16 ratings

Munich Re Group(1) .................. 994 A+ second highest of 16 ratings

Berkshire Hathaway Group ............. 591 A++ highest of 16 ratings

American International Group(2) ......... 553 A+ second highest of 16 ratings

XL Capital Group(3) .................. 511 A third highest of 16 ratings

(1) On January 30, 2008, A.M. Best upgraded the financial strength rating of Munich Reinsurance

America, Inc. from ‘‘A’’ to ‘‘A+.’’

(2) On February 14, 2008, A.M. Best placed the financial strength ratings of ‘‘A+’’ of most of

American International Group’s domestic property casualty subsidiaries and its 60% majority-

owned company, Transatlantic Holdings, Inc., under review with negative implications.

(3) On January 25, 2008, A.M. Best downgraded the financial strength rating of XL Capital Group to

‘‘A’’ from ‘‘A+.’’

At December 31, 2007, $3.0 billion of reinsurance recoverables were collateralized by letters of

credit, trust agreements and funds held.

OUTLOOK

The Company’s strategic objective is to enhance its position as a consistently profitable market

leader and a cost-effective provider of property and casualty insurance in the United States and in

selected international markets. A variety of factors continue to affect the property and casualty

insurance market and the Company’s core business outlook for 2008, including competitive conditions

in the markets served by the Company’s business segments, loss cost trends, interest rate trends and the

investment environment.

Competition. The Company expects property casualty market conditions to continue to become

modestly more competitive in 2008, particularly for new business. The pricing environment for new

business generally has less of an impact on underwriting profitability than renewal price changes,

particularly in an environment of high retention rates, which the Company has experienced over the

past several years. In the Business Insurance and the Financial, Professional & International Insurance

segments, the Company expects renewal price changes in 2008 will modestly decline from their 2007

levels. In the Personal Insurance segment, the Company expects automobile and homeowners renewal

price changes will increase slightly compared to their 2007 levels. These expectations for the pricing

environment, when combined with expected modestly increased loss costs, will likely result in somewhat

reduced underwriting profitability in 2008 as compared to 2007.

103