Travelers 2007 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2007 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.funds will be released from escrow to the trust created under ACandS’ plan of reorganization. The

Company funded the escrow through the purchase of short-term securities.

The majority of funds available for investment are deployed in a widely diversified portfolio of

high quality, liquid intermediate-term taxable U.S. government, corporate and mortgage backed bonds

and tax-exempt U.S. municipal bonds. The Company closely monitors the duration of its fixed maturity

investments, and investment purchases and sales are executed with the objective of having adequate

funds available to satisfy the Company’s insurance and debt obligations. The Company’s management

of the duration of the fixed income investment portfolio generally produces a duration that exceeds the

estimated duration of the Company’s net insurance liabilities. The average duration of fixed maturities

and short-term securities was 4.0 at December 31, 2007 and 2006.

The Company also invests much smaller amounts in equity securities, venture capital and real

estate. These investment classes have the potential for higher returns but also involve varying degrees

of risk, including less stable rates of return and less liquidity. During 2007, the Company sold a

substantial portion of its venture capital investment portfolio.

The primary goals of the Company’s asset liability management process are to satisfy the insurance

liabilities, manage the interest rate risk embedded in those insurance liabilities and maintain sufficient

liquidity to cover fluctuations in projected liability cash flows. Generally, the expected principal and

interest payments produced by the Company’s fixed income portfolio adequately fund the estimated

runoff of the Company’s insurance reserves. Although this is not an exact cash flow match in each

period, the substantial degree by which the market value of the fixed income portfolio exceeds the

expected present value of the net insurance liabilities, as well as the positive cash flow from newly sold

policies and the large amount of high quality liquid bonds, provide assurance of the Company’s ability

to fund the payment of claims without having to sell illiquid assets or access credit facilities.

Sale of Subsidiary. The Company’s cash flows in 2005 included $2.40 billion of pretax proceeds

(after underwriting fees and transaction costs) from the divestiture of its equity interest in Nuveen

Investments. Of this amount, $405 million was received directly by the Company’s insurance

subsidiaries, and the remainder was received directly by the holding company. Of the proceeds received

directly by the holding company, $1.225 billion was contributed to the capital of the Company’s

insurance subsidiaries, with the remainder available for general corporate purposes.

Financing Activities

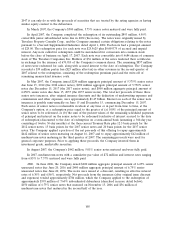

Net cash flows used in financing activities of continuing operations totaled $2.95 billion,

$1.59 billion and $473 million in 2007, 2006 and 2005, respectively. The 2007 total primarily reflected

common share repurchases, the early redemption of debt, the repayment of maturing debt and

dividends to shareholders, partially offset by the issuance of debt and proceeds from employee stock

option exercises. The 2006 total primarily reflected common share repurchases, the early redemption of

debt and the repayment of maturing debt, and dividends to shareholders, partially offset by proceeds

from the issuance of debt and employee stock option exercises. In 2005, the total primarily reflected

the repayment of debt and dividends to shareholders, which were partially offset by the issuance of

common stock pursuant to the maturity of equity unit forward contracts and the issuance of debt.

Debt Transactions.

2007. In January 2007, the Company redeemed $81 million of 8.47% subordinated debentures

originally issued in 1997 and due January 10, 2027. The debentures were redeemable by the Company

on or after January 10, 2007. In January 1997, USF&G Capital II, a business trust, issued $100 million

of capital securities, the proceeds of which, along with $3 million in capital provided by the Company,

were used to purchase the subordinated debentures issued by USF&G Corporation and subsequently

assumed by the Company after the merger of The St. Paul Companies Inc. (SPC) and Travelers

106