Travelers 2007 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2007 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Real Estate

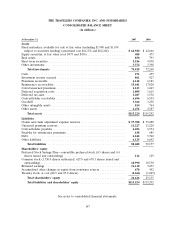

Fair value is established at the time of acquisition by internal analysis or external appraisers, using

discounted cash flow analyses and other acceptable techniques. The Company had no real estate held

for sale at December 31, 2007 or 2006.

Other Investments

The Company’s investment portfolio includes non-publicly traded investments, such as venture

capital investments (as discussed below), private equity limited partnerships, joint ventures, other

limited partnerships, certain fixed income and equity securities, and stock purchase warrants of a

publicly-traded company. The Company uses the equity method of accounting for joint ventures and

limited partnerships. Certain other private equity investments, including venture capital investments, are

reported at estimated fair value. These non-publicly traded securities are valued based on factors such

as recent financial information, available market data, and management judgment.

Venture Capital Investments

In May 2007, the Company completed the bundled sale of a substantial portion of its venture

capital portfolio. Prior to the sale, these venture capital investments were consolidated in the

Company’s financial statements. The Company’s venture capital investments are generally non-publicly

traded instruments in early-stage companies and, historically, have a holding period of four to seven

years. These investments are primarily in the health care, software and computer services, and

networking and information technologies infrastructures industries. Certain venture capital investments

that are controlled by the Company are consolidated in the Company’s financial statements. The

underlying investments of these venture capital investments are reported at estimated fair value. The

fair value of the venture capital investments is based on an estimate determined by the external fund

manager and reviewed by the Company for investments in which there is no public market. The

external fund manager reviews such factors as recent filings, operating results, balance sheet stability,

growth, and other business and market sector fundamental statistics in estimating fair values of specific

investments.

With respect to the Company’s valuation of such non-publicly traded venture capital investments,

on a quarterly basis, the Company’s portfolio managers and the external fund manager review and

consider a variety of factors in determining the valuation of the investments and the potential for

other-than-temporary impairments. Factors considered include the following:

• The investee’s most recent financing events;

• An analysis of whether a fundamental deterioration or improvement has occurred;

• Whether the investee’s progress has been substantially more or less than expected;

• Whether or not the valuations have improved or declined significantly in the investee’s market

sector;

• Whether or not the external fund manager and the Company believe it is probable that the

investee will need financing within six months at a lower price than our carrying value; and

• Whether or not the Company has the ability and intent to hold the investment for a period of

time sufficient to allow for recovery, enabling it to receive value equal to or greater than our

cost.

The quarterly valuation procedures described above are in addition to the portfolio managers’

ongoing responsibility to frequently monitor developments affecting those invested assets, paying

particular attention to events that might give rise to impairment write-downs.

137