Travelers 2007 Annual Report Download - page 218

Download and view the complete annual report

Please find page 218 of the 2007 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

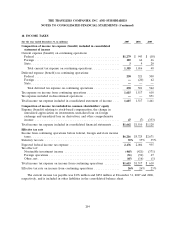

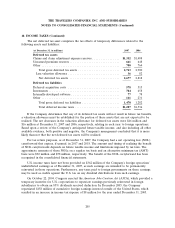

10. INCOME TAXES (Continued)

The Company adopted the provisions of FASB Interpretation No. 48, Accounting for Uncertainty in

Income Taxes, on January 1, 2007. The adoption of FIN 48 did not have a material effect on the

Company’s financial position. A reconciliation of the beginning and ending amount of unrecognized tax

benefits is as follows:

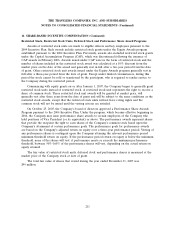

(in millions) 2007

Balance at January 1, 2007 ..................................... $ 339

Additions for tax positions of prior years ........................... 2

Reductions for tax positions of prior years .......................... (172)

Additions based on tax positions related to 2007 ..................... 23

Reductions based on tax positions related to 2007 .................... (49)

Balance at December 31, 2007 ................................. $ 143

Included in the balance at December 31, 2007 were $42 million of unrecognized tax benefits that,

if recognized, would affect the annual effective tax rate and $101 million of tax positions for which the

ultimate deductibility is certain, but for which there is uncertainty about the timing of deductibility. The

timing of such deductibility would not affect the annual effective tax rate.

The Company recognizes accrued interest and penalties, if any, related to unrecognized tax

benefits in income taxes. During the year ended December 31, 2007, the Company recognized

approximately $9 million in interest. The Company had approximately $26 million for the payment of

interest accrued at December 31, 2007.

As of December 31, 2007, the Company effectively settled Internal Revenue Service (IRS) tax

examinations for all years through December 31, 2004. As a result, the Company recorded after-tax

benefits of $86 million in its consolidated statement of income for the year ended December 31, 2007.

In addition, $63 million of previously unrecognized tax benefits related to the IRS settlement were

recognized through a reduction of goodwill.

The IRS is conducting an examination of the Company’s U.S. income tax returns for 2005 through

2006. The Company does not expect any significant changes to its liability for unrecognized tax benefits

during the next twelve months.

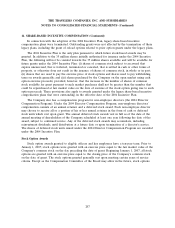

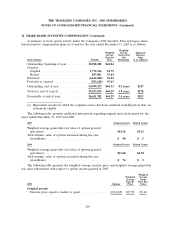

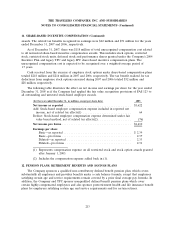

11. SHARE-BASED INCENTIVE COMPENSATION

The Company has a share-based incentive compensation plan, The Travelers Companies, Inc. 2004

Stock Incentive Plan (the 2004 Incentive Plan), which replaced prior share-based incentive

compensation plans (legacy plans). The purposes of the 2004 Incentive Plan are to reward the efforts of

the Company’s non-employee directors, executive officers and other employees and to attract new

personnel by providing incentives in the form of stock-based awards. The 2004 Incentive Plan permits

grants of nonqualified stock options, incentive stock options, stock appreciation rights, restricted stock,

restricted stock units, deferred stock, deferred stock units, performance awards and other stock-based

or stock-denominated awards with respect to the Company’s common stock. The number of shares of

the Company’s common stock authorized for grant under the 2004 Incentive Plan is 35 million shares,

subject to additional shares that may be available for awards as described below. The Company has a

policy of issuing new shares to settle the exercise of stock option awards and the vesting of other equity

awards.

206