Travelers 2007 Annual Report Download - page 113

Download and view the complete annual report

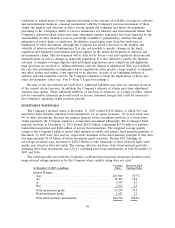

Please find page 113 of the 2007 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.For the year ended December 31, 2007, the Company recognized the following

other-than-temporary impairments:

• $37 million in the fixed maturities portfolio, consisting of $23 million resulting from the potential

to sell various holdings prior to a recovery in market value and $14 million related to credit risk

associated with various issuers’ deteriorated financial position;

• $7 million in the equity portfolio when it was determined that the cost basis of those securities

would not be recovered over the expected holding period;

• $10 million in the real estate portfolio, related to the fundamental decline in the financial

condition of one real estate development property; and

• $16 million in the venture capital portfolio on 14 holdings. Three of the holdings were public

securities whose cost basis was not anticipated to be recovered over the expected holding period.

Nine holdings experienced fundamental economic deterioration (characterized by less than

expected revenues or a fundamental change in product). The remaining two holdings were

impaired due to the impending sale, liquidation or shutdown of the entity.

For the year ended December 31, 2006, the Company recognized the following

other-than-temporary impairments:

• $7 million in the fixed maturities portfolio, consisting of $6 million resulting from the potential

to sell various holdings prior to a recovery in market value and $1 million related to credit risk

associated with various issuers’ deteriorated financial position;

• $4 million in the equity portfolio when it was determined that the cost basis of those securities

would not be recovered over the expected holding period;

• $33 million in the venture capital portfolio on 16 holdings. Four of the holdings were impaired

due to new financings on unfavorable terms. Six holdings experienced fundamental economic

deterioration (characterized by less than expected revenues or a fundamental change in

product). Four of the holdings were impaired due to the impending sale, liquidation or

shutdown of the entity. Two of the holdings were public securities whose cost basis was not

anticipated to be recovered over the expected holding period; and

• $4 million in other investments (excluding venture capital). The loss recorded was the result of

one mortgage loan refinancing at less favorable terms.

For the year ended December 31, 2005, the Company recognized the following

other-than-temporary impairments:

• $11 million in the fixed maturities portfolio related to various issuers due to credit risk

associated with the issuer’s deteriorated financial position;

• $80 million in the venture capital portfolio on 22 holdings. Two of the holdings were impaired

due to new financings on unfavorable terms. Fifteen holdings experienced fundamental economic

deterioration (characterized by less than expected revenues or a fundamental change in

product). Three of the holdings were impaired due to the impending sale, liquidation or

shutdown of the entity. Two of the holdings were public securities whose cost basis was not

anticipated to be recovered over the expected holding period; and

• $18 million in other investments (excluding venture capital). The losses recorded were the result

of an equity partnership and a private stock holding which both experienced fundamental

deterioration in their financial position.

The specific circumstances that led to the impairments described above did not materially impact

other individual investments held during 2007, 2006 or 2005. The Company continually evaluates

101