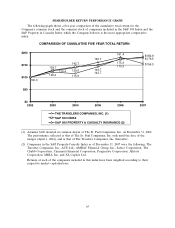

Travelers 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Company is one of several insurer defendants. Xavier is an individual suit involving a property

insurance policy brought by one of the Company’s insureds. All of these actions allege that the losses

were caused by the failure of the New Orleans levees. On November 27, 2006, the district court issued

a ruling in the three consolidated cases denying the motions of the Company and certain other insurers

for a summary disposition of the cases.

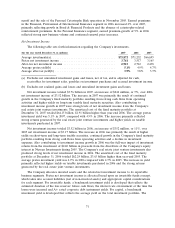

On August 2, 2007, the U.S. Court of Appeals for the Fifth Circuit reversed the district court’s

ruling, holding that there is no coverage for the plaintiffs’ flood losses under the policies at issue

(including policies issued by the Company) because the policies’ flood exclusions unambiguously

exclude coverage. On August 27, 2007, the Fifth Circuit denied the plaintiffs’ petition for rehearing.

The plaintiffs filed a Petition for Writ of Certiorari with the U.S. Supreme Court, which was denied on

February 19, 2008.

The district court to which these cases were remanded following the Fifth Circuit decision

discussed above has issued an order staying all proceedings concerning the interpretation of the flood

exclusion until a decision is rendered in an appeal pending in the Louisiana Supreme Court entitled

Joseph Sher v. Lafayette Insurance Co., et al. Sher is an appeal from a decision of a Louisiana state

appellate court in which, contrary to the Fifth Circuit’s ruling discussed above, certain judges on the

panel ruled that the flood exclusion at issue in the case is ambiguous. Although the Company is not a

party to Sher, the district court issued the stay on the basis that the Louisiana Supreme Court’s

decision in Sher may be relevant to the outcome of the district court cases. Oral argument in Sher is

scheduled for February 26, 2008.

As previously disclosed, as part of ongoing, industry-wide investigations, the Company and its

affiliates have received subpoenas and written requests for information from a number of government

agencies and authorities, including, among others, state attorneys general, state insurance departments,

the U.S. Attorney for the Southern District of New York and the U.S. Securities and Exchange

Commission. The areas of pending inquiry addressed to the Company include its relationship with

brokers and agents and the Company’s involvement with ‘‘non-traditional insurance and reinsurance

products.’’ The Company and its affiliates may receive additional subpoenas and requests for

information with respect to these matters.

The Company is cooperating with these subpoenas and requests for information. In addition,

outside counsel, with the oversight of the Company’s board of directors, conducted an internal review

of certain of the Company’s business practices. This review initially focused on the Company’s

relationship with brokers and was commenced after the announcement of litigation brought by the New

York Attorney General’s office against a major broker.

The internal review was expanded to address the various requests for information described above

and to verify whether the Company’s business practices in these areas have been appropriate. The

Company’s review has been extensive, involving the examination of e-mails and underwriting files, as

well as interviews of current and former employees.

In its review, the Company found only a few instances of conduct that were inconsistent with the

Company’s employee code of conduct and has responded appropriately. The Company’s internal review

with respect to finite reinsurance considered finite products the Company both purchased and sold. The

Company has completed its review with respect to the identified finite products purchased and sold,

and has concluded that no adjustment to previously issued financial statements is required.

Any authority with open inquiries or investigations could ask that additional work be performed or

reach conclusions different from the Company’s. Accordingly, it would be premature to reach any

conclusions as to the likely outcome of the regulatory inquiries described above.

In 2005, four putative class action lawsuits were brought against a number of insurance brokers

and insurers, including the Company and/or certain of its affiliates, by plaintiffs who allegedly

62