Travelers 2007 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2007 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Reserves on Statutory Accounting Basis

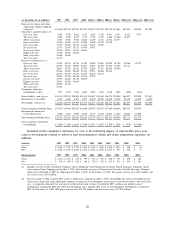

At December 31, 2007, 2006 and 2005, claims and claim adjustment expense reserves (net of

reinsurance) shown in the preceding table, which are prepared in accordance with U.S. generally

accepted accounting principles (GAAP reserves), were $30 million higher, $104 million lower and

$296 million lower, respectively, than those reported in the Company’s respective annual reports filed

with insurance regulators, which are prepared in accordance with statutory accounting practices

(statutory reserves). The accounting for retroactive reinsurance is a significant factor in the difference

in reserves. Retroactive reinsurance balances result from reinsurance placed to cover losses on insured

events occurring prior to the inception of a reinsurance contract. For GAAP reporting, retroactive

reinsurance balances are included in reinsurance recoverables and result in lower net reserve amounts.

Statutory accounting practices require retroactive reinsurance balances to be recorded in other

liabilities as contra-liabilities rather than in loss reserves.

Asbestos and Environmental Claims

Asbestos and environmental claims are segregated from other claims and are handled separately by

the Company’s Special Liability Group, a separate unit staffed by dedicated legal, claim, finance and

engineering professionals. For additional information on asbestos and environmental claims, see

‘‘Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations—

Asbestos Claims and Litigation and—Environmental Claims and Litigation.’’

INTERCOMPANY REINSURANCE POOLING ARRANGEMENTS

Most of the Company’s insurance subsidiaries are members of intercompany property and casualty

reinsurance pooling arrangements. Pooling arrangements permit the participating companies to rely on

the capacity of the entire pool’s capital and surplus rather than just on its own capital and surplus.

Under such arrangements, the members share substantially all insurance business that is written and

allocate the combined premiums, losses and expenses.

On October 1, 2007, retroactive to January 1, 2007, the Northland Pool was commuted and

terminated. Four members of the former Northland Pool, consisting of Northland Insurance Company,

Northfield Insurance Company, Northland Casualty Company and American Equity Specialty Insurance

Company, became members of the Travelers Reinsurance Pool, the Company’s primary reinsurance

pool. The fifth member of the former Northland Pool, American Equity Insurance Company, became a

100% reinsured affiliate of the Travelers Reinsurance Pool. Additionally, the individual 100% quota

share reinsurance agreements for three former 100% reinsured affiliated companies of the Travelers

Reinsurance Pool (St. Paul Guardian Insurance Company, St. Paul Mercury Insurance Company and

Fidelity and Guaranty Insurance Underwriters, Inc.) were commuted and terminated. These three

companies also became members of the Travelers Reinsurance Pool. All of these transactions were

retroactive to January 1, 2007. In addition, on October 1, 2007, Discover Reinsurance Company was

merged into The Travelers Indemnity Company.

RATINGS

Ratings are an important factor in setting the Company’s competitive position in the insurance

industry. The Company receives ratings from the following major rating agencies: A.M. Best Company

(A.M. Best), Fitch Ratings (Fitch), Moody’s Investors Service (Moody’s) and Standard & Poor’s Corp.

(S&P). Rating agencies typically issue two types of ratings: claims-paying (or financial strength) ratings

which assess an insurer’s ability to meet its financial obligations to policyholders and debt ratings which

assess a company’s prospects for repaying its debts and assist lenders in setting interest rates and terms

for a company’s short- and long-term borrowing needs. Agency ratings are not a recommendation to

buy, sell or hold any security, and they may be revised or withdrawn at any time by the rating agency.

27