Travelers 2007 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2007 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

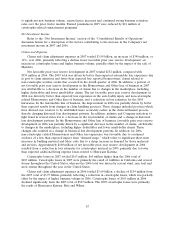

United States. Adjusting for the sale of Mendota for both years, net written premiums in the

Homeowners and Other line of business in 2007 increased 7% over 2006. Net written premiums in

2006 in this line of business grew 10% over 2005. Business retention rates and new business volume

remained strong and increased over 2005. Renewal price changes in 2006 remained positive but

declined from 2005. Net written premium volume in this line of business in 2006 also benefited from

cross-selling initiatives involving the Company’s automobile multivariate pricing product.

The Personal Insurance segment had approximately 7.2 million and 7.0 million policies in force at

December 31, 2007 and 2006, respectively, excluding Mendota in both years. In the Automobile line of

business, policies in force at December 31, 2007 increased 1% over the same date in 2006. Policies in

force in the Homeowners and Other line of business at December 31, 2007 grew by 3% over the same

date in 2006.

Interest Expense and Other

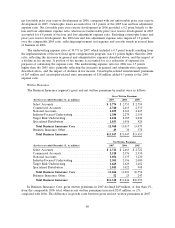

(for the year ended December 31, in millions) 2007 2006 2005

Net loss ....................................... $(209) $(163) $(184)

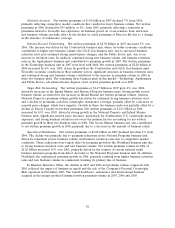

The $46 million increase in net loss for Interest Expense and Other in 2007 compared with 2006

was driven by the impact of debt redemptions in each year. The net loss in 2007 included an after-tax

loss of $25 million related to the Company’s redemption of its 4.50% convertible junior subordinated

notes in April 2007, consisting of the redemption premium paid and the write-off of remaining debt

issuance costs. Conversely, the net loss in 2006 was reduced by a $27 million after-tax gain realized on

the redemption of the Company’s $593 million, 7.6% subordinated debentures. After-tax interest

expense in 2007 totaled $224 million, compared with $207 million in 2006. The net losses in this

category for 2007 and 2006 were reduced by the favorable resolution of various prior year tax matters.

The $21 million decline in net loss for Interest Expense and Other in 2006 compared with 2005

was primarily due to the $27 million after-tax gain referred to above. Results in 2006 also reflected the

favorable resolution of various prior year federal and state tax matters and the absence of expenses

associated with the amortization of discount on forward contracts related to the Company’s divestiture

of Nuveen Investments that impacted the 2005 loss. These factors were partially offset by incremental

interest expense in 2006 due to debt issuances during the year.

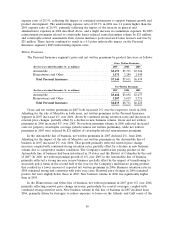

ASBESTOS CLAIMS AND LITIGATION

The Company believes that the property and casualty insurance industry has suffered from court

decisions and other trends that have attempted to expand insurance coverage for asbestos claims far

beyond the intent of insurers and policyholders. While the Company has experienced a decrease in

asbestos claims over the past several years, the Company continues to receive a significant number of

asbestos claims from the Company’s policyholders (which includes others seeking coverage under a

policy), including claims against the Company’s policyholders by individuals who do not appear to be

impaired by asbestos exposure. Factors underlying these claim filings include intensive advertising by

lawyers seeking asbestos claimants and the focus by plaintiffs on previously peripheral defendants. The

focus on these defendants is primarily the result of the number of traditional asbestos defendants who

have sought bankruptcy protection in previous years. In addition to contributing to the overall number

of claims, bankruptcy proceedings may increase the volatility of asbestos-related losses by initially

delaying the reporting of claims and later by significantly accelerating and increasing loss payments by

insurers, including the Company. Bankruptcy proceedings have also caused increased settlement

demands against those policyholders who are not in bankruptcy but that remain in the tort system.

Currently, in many jurisdictions, those who allege very serious injury and who can present credible

medical evidence of their injuries are receiving priority trial settings in the courts, while those who have

90