Target 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

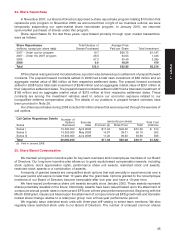

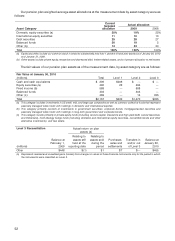

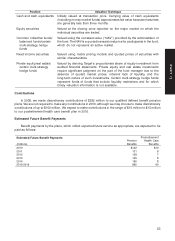

Position Valuation Technique

Cash and cash equivalents Initially valued at transaction price. Carrying value of cash equivalents

(including money market funds) approximates fair value because maturities

are generally less than three months.

Equity securities Valued at the closing price reported on the major market on which the

individual securities are traded.

Common collective funds/ Valued using the net asset value (‘‘NAV’’) provided by the administrator of

balanced funds/certain the fund. The NAV is a quoted transactional price for participants in the fund,

multi-strategy hedge which do not represent an active market.

funds

Fixed income securities Valued using matrix pricing models and quoted prices of securities with

similar characteristics.

Private equity/real estate/ Valued by deriving Target’s proportionate share of equity investment from

certain multi-strategy audited financial statements. Private equity and real estate investments

hedge funds require significant judgment on the part of the fund manager due to the

absence of quoted market prices, inherent lack of liquidity, and the

long-term nature of such investments. Certain multi-strategy hedge funds

represent funds of funds that include liquidity restrictions and for which

timely valuation information is not available.

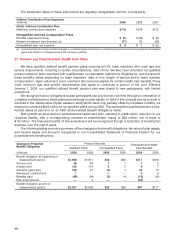

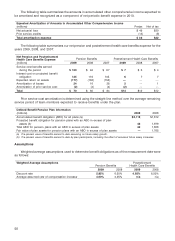

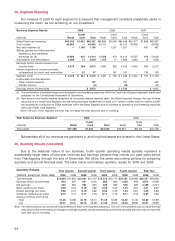

Contributions

In 2009, we made discretionary contributions of $252 million to our qualified defined benefit pension

plans. We are not required to make any contributions in 2010, although we may choose to make discretionary

contributions of up to $100 million. We expect to make contributions in the range of $10 million to $15 million

to our postretirement health care benefit plan in 2010.

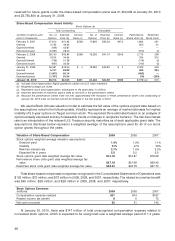

Estimated Future Benefit Payments

Benefit payments by the plans, which reflect expected future service as appropriate, are expected to be

paid as follows:

Postretirement

Estimated Future Benefit Payments

Pension Health Care

(millions) Benefits Benefits

2010 $122 $10

2011 131 9

2012 138 7

2013 145 8

2014 155 8

2015-2019 895 60

53

PART II