Target 2009 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2009 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

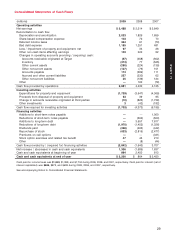

later years. Net property and equipment decreased $475 million in 2009 following an increase of

$1,661 million in 2008.

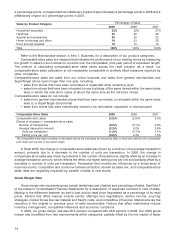

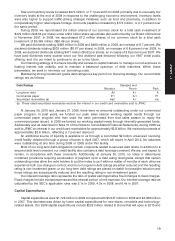

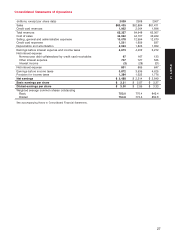

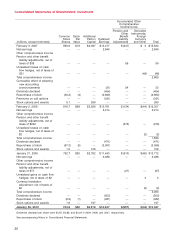

Percentage of Capital Expenditures

Capital Expenditures

2009 2008 2007

New stores 52% 66% 71%

Remodels and expansions 17 87

Information technology, distribution and other 31 26 22

Total 100% 100% 100%

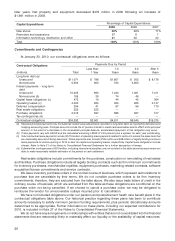

Commitments and Contingencies

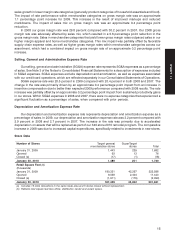

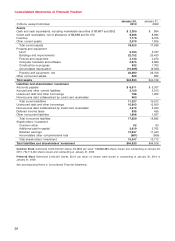

At January 30, 2010, our contractual obligations were as follows:

Payments Due by Period

Contractual Obligations

Less than 1-3 3-5 After 5

(millions) Total 1 Year Years Years Years

Long-term debt (a)

Unsecured $11,071 $ 786 $1,607 $ 502 $ 8,176

Nonrecourse 5,553 900 750 3,903 —

Interest payments – long-term

debt

Unsecured 10,405 693 1,240 1,061 7,411

Nonrecourse (b) 159 39 74 46 —

Capital lease obligations (c) 472 19 44 45 364

Operating leases (c) 4,000 264 324 265 3,147

Deferred compensation 394 41 87 96 170

Real estate obligations 222 222 — — —

Purchase obligations 2,016 597 685 627 107

Tax contingencies (d) —————

Contractual obligations $34,292 $3,561 $4,811 $6,545 $19,375

(a) Required principal payments only. Excludes fair market value adjustments recorded in long-term debt, as required by derivative and

hedging accounting rules. Principal amounts include the 47 percent interest in credit card receivables sold to JPMC at the principal

amount. In the event of a decrease in the receivables principal balance, accelerated repayment of this obligation may occur.

(b) These payments vary with LIBOR and are calculated assuming LIBOR of 0.25 percent plus a spread, for each year outstanding.

(c) Total contractual lease payments include $2,016 million of operating lease payments related to options to extend the lease term that

are reasonably assured of being exercised. These payments also include $196 million and $88 million of legally binding minimum

lease payments for stores opening in 2010 or later for capital and operating leases, respectively. Capital lease obligations include

interest. Refer to Note 21 of the Notes to Consolidated Financial Statements for a further description of leases.

(d) Estimated tax contingencies of $579 million, including interest and penalties, are not included in the table above because we are not

able to make reasonably reliable estimates of the period of cash settlement.

Real estate obligations include commitments for the purchase, construction or remodeling of real estate

and facilities. Purchase obligations include all legally binding contracts such as firm minimum commitments

for inventory purchases, merchandise royalties, equipment purchases, marketing-related contracts, software

acquisition/license commitments and service contracts.

We issue inventory purchase orders in the normal course of business, which represent authorizations to

purchase that are cancelable by their terms. We do not consider purchase orders to be firm inventory

commitments; therefore, they are excluded from the table above. We also issue trade letters of credit in the

ordinary course of business, which are excluded from this table as these obligations are conditional on the

purchase order not being cancelled. If we choose to cancel a purchase order, we may be obligated to

reimburse the vendor for unrecoverable outlays incurred prior to cancellation.

We have not included obligations under our pension and postretirement health care benefit plans in the

contractual obligations table above. Our historical practice regarding these plans has been to contribute

amounts necessary to satisfy minimum pension funding requirements, plus periodic discretionary amounts

determined to be appropriate. Further information on these plans, including our expected contributions for

2010, is included in Note 27 of the Notes to Consolidated Financial Statements.

We do not have any arrangements or relationships with entities that are not consolidated into the financial

statements that are reasonably likely to materially affect our liquidity or the availability of capital resources.

20