Target 2009 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2009 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and

Issuer Purchases of Equity Securities

Our common stock is listed on the New York Stock Exchange under the symbol ‘‘TGT.’’ We are authorized

to issue up to 6,000,000,000 shares of common stock, par value $0.0833, and up to 5,000,000 shares of

preferred stock, par value $0.01. At March 10, 2010, there were 17,562 shareholders of record. Dividends

declared per share and the high and low closing common stock price for each fiscal quarter during 2009 and

2008 are disclosed in Note 29 of the Notes to Consolidated Financial Statements, included in Item 8, Financial

Statements and Supplementary Data.

In November 2007, our Board of Directors authorized the repurchase of $10 billion of our common stock.

In November 2008 we announced a temporary suspension of our open-market share repurchase program. In

January 2010, we resumed open-market purchases of shares under this program. Since the inception of this

share repurchase program, we have repurchased 103.6 million common shares for a total cash investment of

$5,320 million ($51.36 per share).

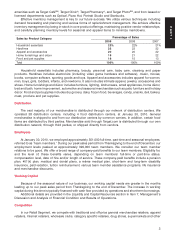

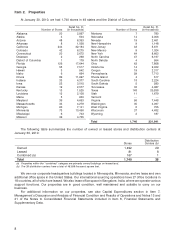

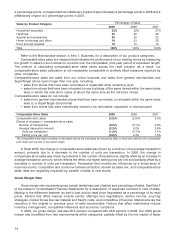

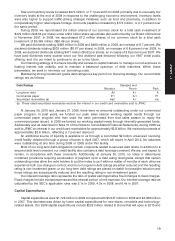

The table below presents information with respect to Target common stock purchases made during the

three months ended January 30, 2010, by Target or any ‘‘affiliated purchaser’’ of Target, as defined in

Rule 10b-18(a)(3) under the Exchange Act.

Approximate

Total Number of Dollar Value of

Shares Purchased Shares that May

Total Number Average as Part of Yet Be Purchased

of Shares Price Paid Publicly Announced Under the

Period Purchased per Share Program Program

November 1, 2009 through

November 28, 2009 — $ — 95,235,594 $ 5,103,322,945

November 29, 2009 through

January 2, 2010 — — 95,235,594 5,103,322,945

January 3, 2010 through

January 30, 2010 8,335,800 50.74 103,571,394 4,680,327,198

8,335,800 $50.74 103,571,394 $4,680,327,198

The table above includes shares of common stock reacquired from team members who wish to tender owned shares to satisfy the tax

withholding on equity awards as part of our long-term incentive plans or to satisfy the exercise price on stock option exercises. For the three

months ended January 30, 2010, 11,960 shares were acquired at an average per share price of $50.17 pursuant to our long-term incentive

plans.

The table above includes shares reacquired upon settlement of prepaid forward contracts. For the three months ended January 30, 2010,

no shares were reacquired through these contracts. At January 30, 2010, we held asset positions in prepaid forward contracts for

1.5 million shares of our common stock, for a total cash investment of $66 million, or an average per share price of $42.77. Refer to

Notes 24 and 26 of the Notes to Consolidated Financial Statements for further details of these contracts.

11

PART II