Target 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

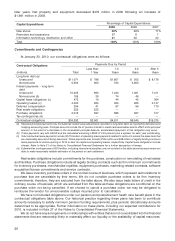

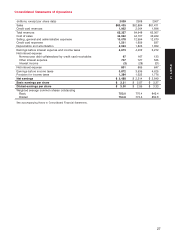

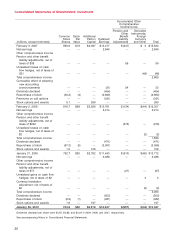

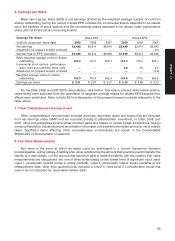

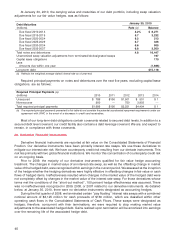

Consolidated Statements of Shareholders’ Investment

Accumulated Other

Comprehensive

Income/(Loss)

Pension and Derivative

Other Instruments,

Common Stock Additional Benefit Foreign

Stock Par Paid-in Retained Liability Currency

(millions, except footnotes) Shares Value Capital Earnings Adjustments and Other Total

February 3, 2007 859.8 $72 $2,387 $13,417 $ (247) $ 4 $ 15,633

Net earnings — — — 2,849 — — 2,849

Other comprehensive income

Pension and other benefit

liability adjustments, net of

taxes of $38 — — — — 59 — 59

Unrealized losses on cash

flow hedges, net of taxes of

$31 — — — — — (48) (48)

Total comprehensive income 2,860

Cumulative effect of adopting

new accounting

pronouncements — — — (31) 54 — 23

Dividends declared — — — (454) — — (454)

Repurchase of stock (46.2) (4) — (2,689) — — (2,693)

Premiums on call options — — — (331) — — (331)

Stock options and awards 5.1 — 269 — — — 269

February 2, 2008 818.7 $68 $2,656 $12,761 $ (134) $(44) $ 15,307

Net earnings — — — 2,214 — — 2,214

Other comprehensive income

Pension and other benefit

liability adjustments, net of

taxes of $242 — — — — (376) — (376)

Unrealized losses on cash

flow hedges, net of taxes of

$2 — — — — — (2) (2)

Total comprehensive income 1,836

Dividends declared — — — (471) — — (471)

Repurchase of stock (67.2) (5) — (3,061) — — (3,066)

Stock options and awards 1.2 — 106 — — — 106

January 31, 2009 752.7 $63 $2,762 $11,443 $ (510) $(46) $ 13,712

Net earnings — — — 2,488 — — 2,488

Other comprehensive income

Pension and other benefit

liability adjustments, net of

taxes of $17 — — — — (27) — (27)

Unrealized gains on cash flow

hedges, net of taxes of $2 — — — — — 4 4

Currency translation

adjustment, net of taxes of

$0 — — — — — (2) (2)

Total comprehensive income 2,463

Dividends declared — — — (503) — — (503)

Repurchase of stock (9.9) (1) — (481) — — (482)

Stock options and awards 1.8 — 157 — — — 157

January 30, 2010 744.6 $62 $2,919 $12,947 $(537) $(44) $15,347

Dividends declared per share were $0.67, $0.62, and $0.54 in 2009, 2008, and 2007, respectively.

See accompanying Notes to Consolidated Financial Statements.

30