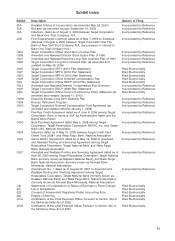

Target 2009 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2009 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

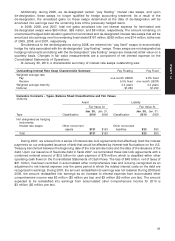

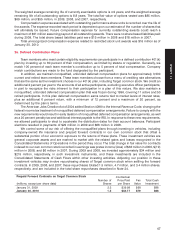

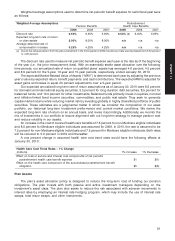

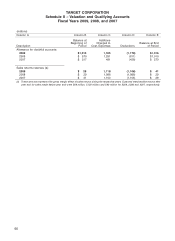

Weighted average assumptions used to determine net periodic benefit expense for each fiscal year were

as follows:

PostretirementWeighted Average Assumptions

Pension Benefits Health Care Benefits

2009 2008 2007 2009 2008 2007

Discount rate 6.50% 6.45% 5.95% 6.50% (a) 6.45% 5.95%

Expected long-term rate of return

on plan assets 8.00% 8.00% 8.00% n/a n/a n/a

Average assumed rate of

compensation increase 4.25% 4.25% 4.25% n/a n/a n/a

(a) Due to the remeasurement from the plan amendment in the third quarter of 2009, the discount rate was decreased from 6.50 percent

to 4.85 percent.

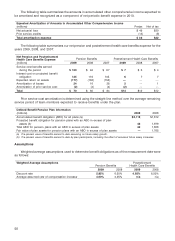

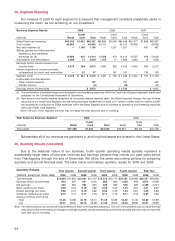

The discount rate used to measure net periodic benefit expense each year is the rate as of the beginning

of the year (i.e., the prior measurement date). With an essentially stable asset allocation over the following

time periods, our annualized rate of return on qualified plans’ assets has averaged 4.6 percent, 4.5 percent

and 8.9 percent for the 5-year, 10-year and 15-year periods, respectively, ended January 30, 2010.

The expected Market-Related Value of Assets (‘‘MRV’’) is determined each year by adjusting the previous

year’s value by expected return, benefit payments, and cash contributions. The expected MRV is adjusted for

asset gains and losses in equal 20 percent adjustments over a 5-year period.

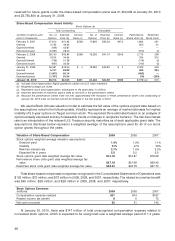

Our expected annualized long-term rate of return assumptions as of January 30, 2010 were 8.5 percent

for domestic and international equity securities, 5.5 percent for long-duration debt securities, 8.5 percent for

balanced funds, and 10.0 percent for other investments. Balanced funds primarily invest in equities, nominal

and inflation-linked fixed income securities, commodities, and public real estate. They seek to generate

capital market returns while reducing market risk by investing globally in highly diversified portfolios of public

securities. These estimates are a judgmental matter in which we consider the composition of our asset

portfolio, our historical long-term investment performance and current market conditions. We review the

expected long-term rate of return on an annual basis, and revise it accordingly. Additionally, we monitor the

mix of investments in our portfolio to ensure alignment with our long-term strategy to manage pension cost

and reduce volatility in our assets.

An increase in the cost of covered health care benefits of 7.5 percent for non-Medicare eligible individuals

and 8.5 percent for Medicare eligible individuals was assumed for 2009. In 2010, the rate is assumed to be

7.5 percent for non-Medicare eligible individuals and 7.5 percent for Medicare eligible individuals. Both rates

will be reduced to 5.0 percent in 2019 and thereafter.

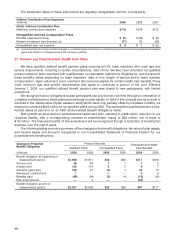

A one percent change in assumed health care cost trend rates would have the following effects at

January 30, 2010:

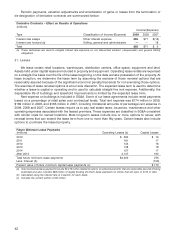

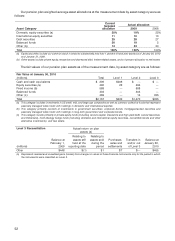

Health Care Cost Trend Rates – 1% Change

(millions) 1% Increase 1% Decrease

Effect on total of service and interest cost components of net periodic

postretirement health care benefit expense $1 $(1)

Effect on the health care component of the accumulated postretirement benefit

obligation $5 $(5)

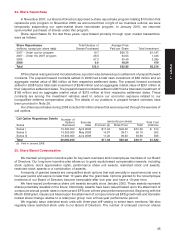

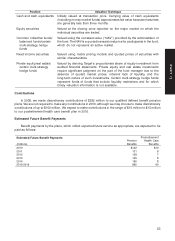

Plan Assets

The plan’s asset allocation policy is designed to reduce the long-term cost of funding our pension

obligations. The plan invests with both passive and active investment managers depending on the

investment’s asset class. The plan also seeks to reduce the risk associated with adverse movements in

interest rates by employing an interest rate hedging program, which may include the use of interest rate

swaps, total return swaps, and other instruments.

51

PART II