Target 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

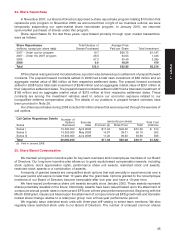

Additionally, during 2008, we de-designated certain ‘‘pay floating’’ interest rate swaps, and upon

de-designation, these swaps no longer qualified for hedge accounting treatment. As a result of the

de-designation, the unrealized gains on these swaps determined at the date of de-designation will be

amortized into earnings over the remaining lives of the previously hedged items.

In 2009, 2008, and 2007, total net gains amortized into net interest expense for terminated and

de-designated swaps were $60 million, $55 million, and $6 million, respectively. The amount remaining on

unamortized hedged debt valuation gains from terminated and de-designated interest rate swaps that will be

amortized into earnings over the remaining lives totaled $197 million, $263 million, and $14 million, at the end

of 2009, 2008, and 2007, respectively.

Simultaneous to the de-designations during 2008, we entered into ‘‘pay fixed’’ swaps to economically

hedge the risks associated with the de-designated ‘‘pay floating’’ swaps. These swaps are not designated as

hedging instruments and along with the de-designated ‘‘pay floating’’ swaps are measured at fair value on a

quarterly basis. Changes in fair value measurements are a component of net interest expense on the

Consolidated Statements of Operations.

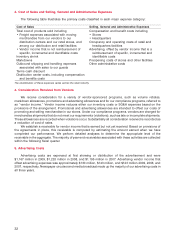

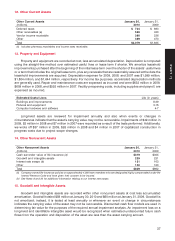

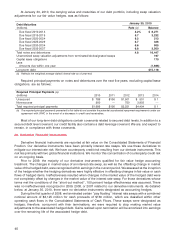

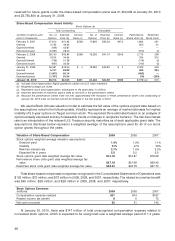

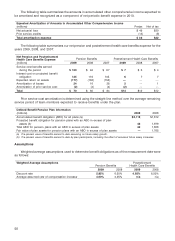

At January 30, 2010, a characteristic summary of interest rate swaps outstanding was:

Outstanding Interest Rate Swap Characteristic Summary Pay Floating Pay Fixed

Weighted average rate:

Pay one-month LIBOR 2.6% fixed

Receive 5.0% fixed one-month LIBOR

Weighted average maturity 4.4 years 4.4 years

Notional $1,250 $1,250

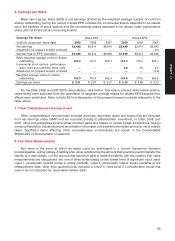

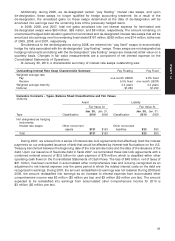

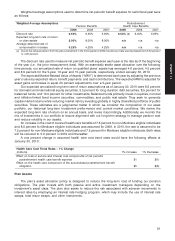

Derivative Contracts – Types, Balance Sheet Classifications and Fair Values

(millions)

Asset Liability

Fair Value At Fair Value At

Jan. 30, Jan. 31, Jan. 30, Jan. 31,

Type Classification 2010 2009 Classification 2010 2009

Not designated as hedging

instruments:

Interest rate swaps Other noncurrent Other noncurrent

assets $131 $163 liabilities $23 $30

Total $131 $163 $23 $30

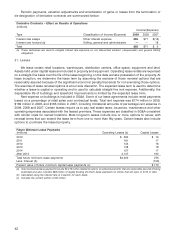

During 2007, we entered into a series of interest rate lock agreements that effectively fixed the interest

payments on our anticipated issuance of debt that would be affected by interest-rate fluctuations on the U.S.

Treasury benchmark between the beginning date of the interest rate locks and the date of the issuance of the

debt. Upon our issuance of fixed-rate debt in fiscal 2007, we terminated these rate lock agreements with a

combined notional amount of $2.5 billion for cash payment of $79 million, which is classified within other

operating cash flows on the Consolidated Statements of Cash Flows. The loss of $48 million, net of taxes of

$31 million, has been recorded in accumulated other comprehensive loss and is being recognized as an

adjustment to net interest expense over the same period in which the related interest costs on the debt are

recognized in earnings. During 2007, the amount reclassified into earnings was not material. During 2008 and

2009, the amount reclassified into earnings as an increase to interest expense from accumulated other

comprehensive income was $3 million ($5 million pre tax) and $3 million ($5 million pre tax). The amount

expected to be reclassified into earnings from accumulated other comprehensive income for 2010 is

$3 million ($5 million pre tax).

41

PART II