Target 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

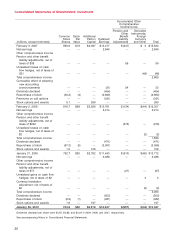

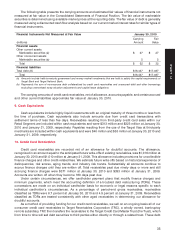

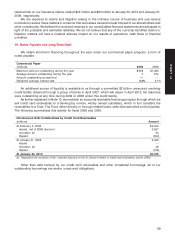

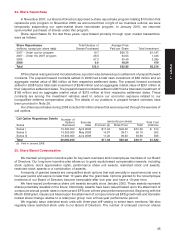

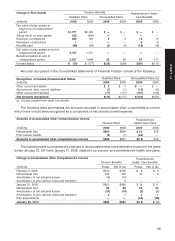

At January 30, 2010, the carrying value and maturities of our debt portfolio, including swap valuation

adjustments for our fair value hedges, was as follows:

January 30, 2010

Debt Maturities

(millions) Rate (a) Balance

Due fiscal 2010-2014 3.2% $ 8,271

Due fiscal 2015-2019 5.7 3,232

Due fiscal 2020-2024 9.2 213

Due fiscal 2025-2029 6.7 326

Due fiscal 2030-2034 6.6 905

Due fiscal 2035-2037 6.8 3,500

Total notes and debentures 4.8 16,447

Unamortized swap valuation adjustments from terminated/de-designated swaps 197

Capital lease obligations 170

Less:

Amounts due within one year (1,696)

Long-term debt $15,118

(a) Reflects the weighted average stated interest rate as of year-end.

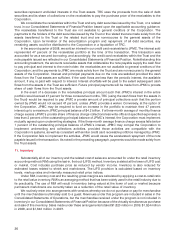

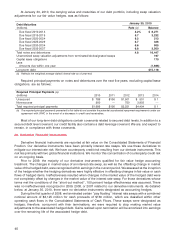

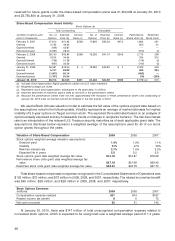

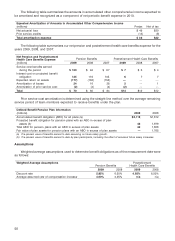

Required principal payments on notes and debentures over the next five years, excluding capital lease

obligations, are as follows:

Required Principal Payments (a)

(millions) 2010 2011 2012 2013 2014

Unsecured $ 786 $106 $1,501 $ 501 $ 1

Nonrecourse 900 — 750 3,903 —

Total required principal payments $1,686 $106 $2,251 $4,404 $ 1

(a) The required principal payments presented in this table do not consider the potential accelerated repayment requirements under our

agreement with JPMC in the event of a decrease in credit card receivables.

Most of our long-term debt obligations contain covenants related to secured debt levels. In addition to a

secured debt level covenant, our credit facility also contains a debt leverage covenant. We are, and expect to

remain, in compliance with these covenants.

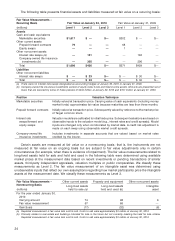

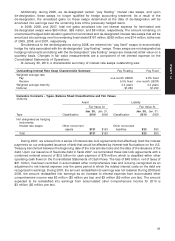

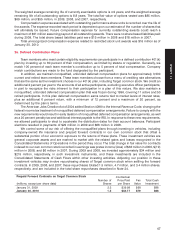

20. Derivative Financial Instruments

Derivative financial instruments are reported at fair value on the Consolidated Statements of Financial

Position. Our derivative instruments have been primarily interest rate swaps. We use these derivatives to

mitigate our interest rate risk. We have counterparty credit risk resulting from our derivate instruments. This

risk lies primarily with two global financial institutions. We monitor this concentration of counterparty credit risk

on an ongoing basis.

Prior to 2009, the majority of our derivative instruments qualified for fair value hedge accounting

treatment. The changes in market value of an interest rate swap, as well as the offsetting change in market

value of the hedged debt, were recognized within earnings in the current period. We assessed at the inception

of the hedge whether the hedging derivatives were highly effective in offsetting changes in fair value or cash

flows of hedged items. Ineffectiveness resulted when changes in the market value of the hedged debt were

not completely offset by changes in the market value of the interest rate swap. For those derivatives whose

terms met the conditions of the ‘‘short-cut method’’, 100 percent hedge effectiveness was assumed. There

was no ineffectiveness recognized in 2009, 2008, or 2007 related to our derivative instruments. As detailed

below, at January 30, 2010, there were no derivative instruments designated as accounting hedges.

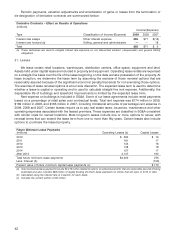

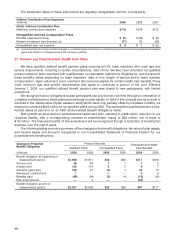

During the first quarter of 2008, we terminated certain ‘‘pay floating’’ interest rate swaps with a combined

notional amount of $3,125 million for cash proceeds of $160 million, which are classified within other

operating cash flows in the Consolidated Statements of Cash Flows. These swaps were designated as

hedges; therefore, concurrent with their terminations, we were required to stop making market value

adjustments to the associated hedged debt. Gains realized upon termination will be amortized into earnings

over the remaining life of the associated hedge debt.

40