Target 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

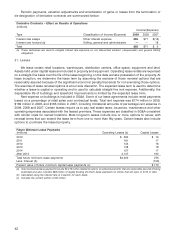

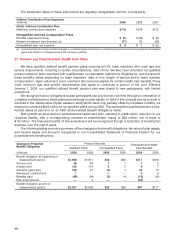

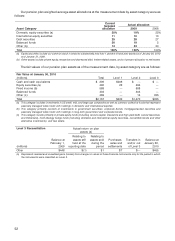

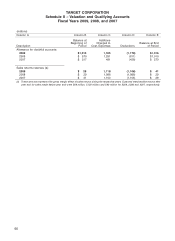

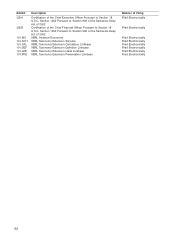

Our pension plan weighted average asset allocations at the measurement date by asset category were as

follows:

Current Actual allocation

targeted

Asset Category allocation 2009 2008

Domestic equity securities (a) 20% 19% 25%

International equity securities 11 10 13

Debt securities 25 28 27

Balanced funds 30 19 5

Other (b) 14 24 30

Total 100% 100% 100%

(a) Equity securities include our common stock in amounts substantially less than 1 percent of total plan assets as of January 30, 2010

and January 31, 2009.

(b) Other assets include private equity, mezzanine and distressed debt, timber-related assets, and a 4 percent allocation to real estate.

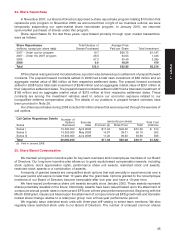

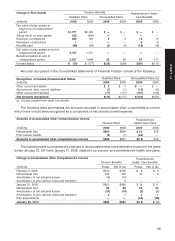

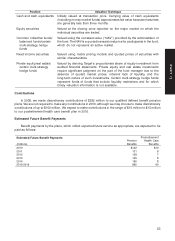

The fair values of our pension plan assets as of the measurement date, by asset category are as follows:

Fair Value at January 30, 2010

(millions) Total Level 1 Level 2 Level 3

Cash and cash equivalents $ 206 $206 $ — $ —

Equity securities (a) 490 26 464 —

Fixed income (b) 588 — 588 —

Balanced funds 404 — 404 —

Other (c) 469 — 14 455

Total $2,157 $232 $1,470 $455

(a) This category includes investments in US small, mid, and large cap companies as well as common collective funds that represent

passively managed index funds with holdings in domestic and international equities.

(b) This category primarily consists of investments in government securities, corporate bonds, mortgage-backed securities and

passively managed index funds with holdings in long-term government and corporate bonds.

(c) This category invests primarily in private equity funds (including venture capital, mezzanine and high yield debt, natural resources,

and timberland), multi-strategy hedge funds (including domestic and international equity securities, convertible bonds and other

alternative investments), and real estate.

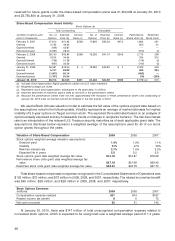

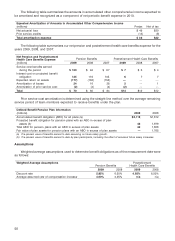

Level 3 Reconciliation Actual return on plan

assets (a)

Relating to Relating to

Balance at assets still assets sold Purchases, Transfers in Balance at

February 1, held at the during the sales and and/or out January 30,

(millions) 2009 reporting date period settlements of Level 3 2010

Other $448 $(1) $1 $7 $— $455

(a) Represents realized and unrealized gains (losses) from changes in values of those financial instruments only for the period in which

the instruments were classified as Level 3.

52