Target 2009 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2009 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

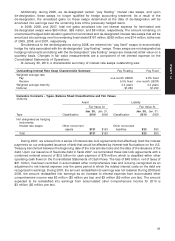

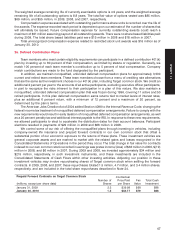

No material impairments related to goodwill and intangible assets were recorded in 2009, 2008, or 2007

as a result of the tests performed. Intangible assets by major classes were as follows:

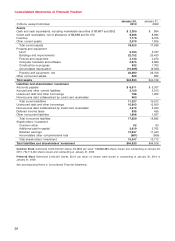

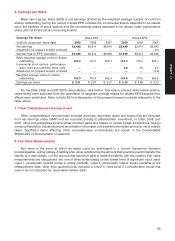

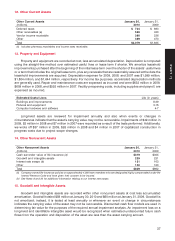

Intangible Assets Leasehold

Acquisition Costs Other (a) Total

Jan. 30, Jan. 31, Jan. 31,

Jan. 30, Jan. 31, Jan. 30,

(millions) 2010 2009 2010 2009 2010 2009

Gross asset $197 $196 $ 150 $ 129 $ 347 $ 325

Accumulated amortization (62) (54) (105) (100) (167) (154)

Net intangible assets $135 $142 $45 $29 $ 180 $ 171

(a) Other intangible assets relate primarily to acquired trademarks and customer lists.

Amortization is computed on intangible assets with definite useful lives using the straight-line method

over estimated useful lives that typically range from 9 to 39 years for leasehold acquisition costs and from 3 to

15 years for other intangible assets. Amortization expense for 2009, 2008, and 2007 was $24 million,

$21 million, and $15 million, respectively.

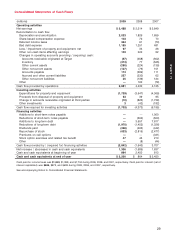

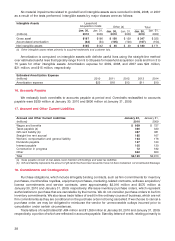

Estimated Amortization Expense

(millions) 2010 2011 2012 2013 2014

Amortization expense $23 $18 $13 $11 $10

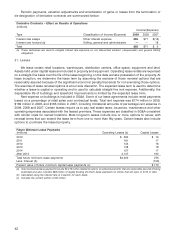

16. Accounts Payable

We reclassify book overdrafts to accounts payable at period end. Overdrafts reclassified to accounts

payable were $539 million at January 30, 2010 and $606 million at January 31, 2009.

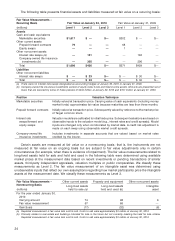

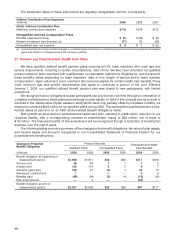

17. Accrued and Other Current Liabilities

Accrued and Other Current Liabilities January 30, January 31,

(millions) 2010 2009

Wages and benefits $ 959 $ 727

Taxes payable (a) 490 430

Gift card liability (b) 387 381

Straight-line rent accrual 185 167

Workers’ compensation and general liability 163 176

Dividends payable 127 120

Interest payable 105 130

Construction in progress 72 182

Other 632 600

Total $3,120 $2,913

(a) Taxes payable consist of real estate, team member withholdings and sales tax liabilities.

(b) Gift card liability represents the amount of gift cards that have been issued but have not been redeemed, net of estimated breakage.

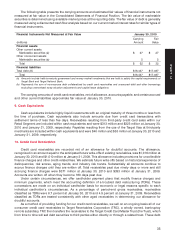

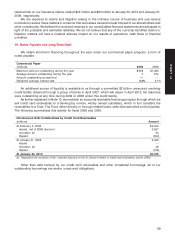

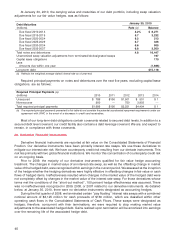

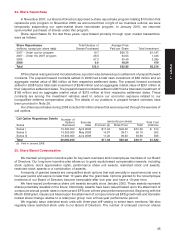

18. Commitments and Contingencies

Purchase obligations, which include all legally binding contracts, such as firm commitments for inventory

purchases, merchandise royalties, equipment purchases, marketing-related contracts, software acquisition/

license commitments and service contracts, were approximately $2,016 million and $570 million at

January 30, 2010 and January 31, 2009, respectively. We issue inventory purchase orders, which represent

authorizations to purchase that are cancelable by their terms. We do not consider purchase orders to be firm

inventory commitments. We also issue trade letters of credit in the ordinary course of business, which are not

firm commitments as they are conditional on the purchase order not being cancelled. If we choose to cancel a

purchase order, we may be obligated to reimburse the vendor for unrecoverable outlays incurred prior to

cancellation under certain circumstances.

Trade letters of credit totaled $1,484 million and $1,359 million at January 30, 2010 and January 31, 2009,

respectively, a portion of which are reflected in accounts payable. Standby letters of credit, relating primarily to

38