Target 2009 Annual Report Download - page 43

Download and view the complete annual report

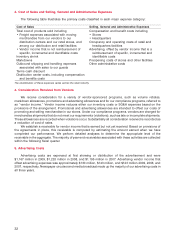

Please find page 43 of the 2009 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.carrying value of the asset may not be recoverable. Impairment on long-lived assets of $49 million in 2009,

$2 million in 2008 and $7 million in 2007 were recorded as a result of the tests performed.

Our estimates of future cash flows require us to make assumptions and to apply judgment, including

forecasting future sales and expenses and estimating useful lives of the assets. These estimates can be

affected by factors such as future store results, real estate values, and economic conditions that can be

difficult to predict.

Insurance/self-insurance We retain a substantial portion of the risk related to certain general liability,

workers’ compensation, property loss and team member medical and dental claims. However, we maintain

stop-loss coverage to limit the exposure related to certain risks. Liabilities associated with these losses include

estimates of both claims filed and losses incurred but not yet reported. We estimate our ultimate cost based

on an analysis of historical data and actuarial estimates. General liability and workers’ compensation liabilities

are recorded at our estimate of their net present value; other liabilities referred to above are not discounted.

We believe that the amounts accrued are adequate, although actual losses may differ from the amounts

provided. Refer to Item 7A for further disclosure of the market risks associated with these exposures.

Income taxes We pay income taxes based on the tax statutes, regulations and case law of the various

jurisdictions in which we operate. Significant judgment is required in determining income tax provisions and in

evaluating the ultimate resolution of tax matters in dispute with tax authorities. Historically, our assessments of

the ultimate resolution of tax issues have been materially accurate. The current open tax issues are not

dissimilar in size or substance from historical items. We believe the resolution of these matters will not have a

material impact on our consolidated financial statements. Income taxes are described further in Note 22 of the

Notes to Consolidated Financial Statements.

Pension and postretirement health care accounting We fund and maintain a qualified defined benefit

pension plan. We also maintain several smaller nonqualified plans and a postretirement health care plan for

certain current and retired team members. The costs for these plans are determined based on actuarial

calculations using the assumptions described in the following paragraphs. Eligibility for, and the level of, these

benefits varies depending on team members’ full-time or part-time status, date of hire and/or length of service.

Our expected long-term rate of return on plan assets is determined by the portfolio composition, historical

long-term investment performance and current market conditions. Benefits expense recorded during the year

is partially dependent upon the long-term rate of return used, and a 0.1 percent decrease in the expected

long-term rate of return used to determine net pension and postretirement health care benefits expense would

increase annual expense by approximately $2 million.

The discount rate used to determine benefit obligations is adjusted annually based on the interest rate for

long-term high-quality corporate bonds as of the measurement date using yields for maturities that are in line

with the duration of our pension liabilities. Historically, this same discount rate has also been used to

determine net pension and postretirement health care benefits expense for the following plan year. The

discount rates used to determine benefit obligations and benefits expense are included in Note 27 of the

Notes to Consolidated Financial Statements. Benefits expense recorded during the year is partially

dependent upon the discount rates used, and a 0.1 percent decrease to the weighted average discount rate

used to determine net pension and postretirement health care benefits expense would increase annual

expense by approximately $4 million.

Based on our experience, we use a graduated compensation growth schedule that assumes higher

compensation growth for younger, shorter-service pension-eligible team members than it does for older,

longer-service pension-eligible team members.

Pension and postretirement health care benefits are further described in Note 27 of the Notes to

Consolidated Financial Statements.

New Accounting Pronouncements

Future Adoptions

In June 2009, the FASB issued SFAS No. 166, ‘‘Accounting for Transfers of Financial Assets an

amendment of FASB Statement No. 140’’ (SFAS 166), codified in the Transfers and Servicing accounting

principles, which amends the derecognition guidance in former FASB Statement No. 140 and eliminates the

exemption from consolidation for qualifying special-purpose entities. This guidance will be effective for the

22