Target 2009 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2009 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

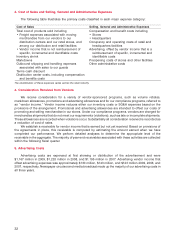

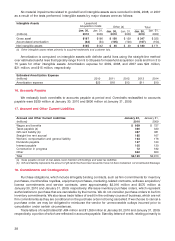

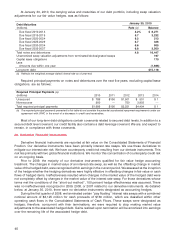

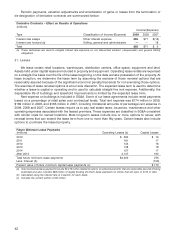

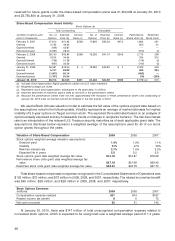

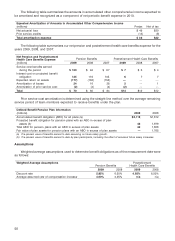

Periodic payments, valuation adjustments and amortization of gains or losses from the termination or

de-designation of derivative contracts are summarized below:

Derivative Contracts – Effect on Results of Operations

(millions)

Income/(Expense)

Type Classification of Income/(Expense) 2009 2008 2007

Interest rate swaps Other interest expense $65 $71 $(15)

Interest rate forward (a) Selling, general and administrative ——18

Total $65 $71 $ 3

(a) These derivatives are used to mitigate interest rate exposure on our discounted workers’ compensation and general liability

obligations.

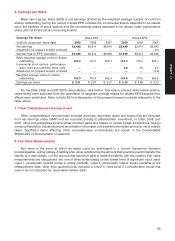

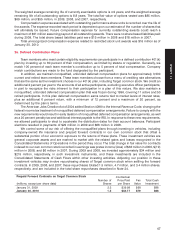

21. Leases

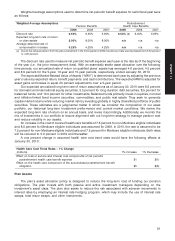

We lease certain retail locations, warehouses, distribution centers, office space, equipment and land.

Assets held under capital lease are included in property and equipment. Operating lease rentals are expensed

on a straight-line basis over the life of the lease beginning on the date we take possession of the property. At

lease inception, we determine the lease term by assuming the exercise of those renewal options that are

reasonably assured because of the significant economic penalty that exists for not exercising those options.

The exercise of lease renewal options is at our sole discretion. The expected lease term is used to determine

whether a lease is capital or operating and is used to calculate straight-line rent expense. Additionally, the

depreciable life of buildings and leasehold improvements is limited by the expected lease term.

Rent expense on buildings is included in SG&A. Some of our lease agreements include rental payments

based on a percentage of retail sales over contractual levels. Total rent expense was $174 million in 2009,

$169 million in 2008, and $165 million in 2007, including immaterial amounts of percentage rent expense in

2009, 2008 and 2007. Certain leases require us to pay real estate taxes, insurance, maintenance and other

operating expenses associated with the leased premises. These expenses are classified in SG&A consistent

with similar costs for owned locations. Most long-term leases include one or more options to renew, with

renewal terms that can extend the lease term from one to more than fifty years. Certain leases also include

options to purchase the leased property.

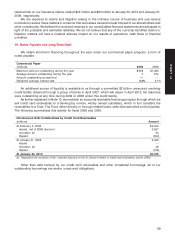

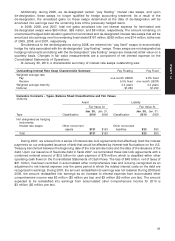

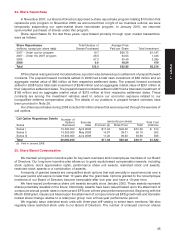

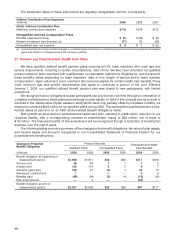

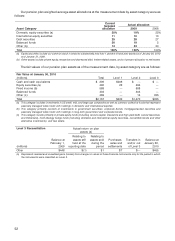

Future Minimum Lease Payments

(millions) Operating Leases (a) Capital Leases

2010 $ 264 $ 16

2011 181 17

2012 143 18

2013 138 18

2014 127 17

After 2014 3,147 190

Total future minimum lease payments $4,000 276

Less: Interest (b) (106)

Present value of future minimum capital lease payments (c) $ 170

(a) Total contractual lease payments include $2,016 million related to options to extend lease terms that are reasonably assured of being

exercised and also includes $88 million of legally binding minimum lease payments for stores that will open in 2010 or later.

(b) Calculated using the interest rate at inception for each lease.

(c) Includes the current portion of $5 million.

42