Target 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24. Share Repurchase

In November 2007, our Board of Directors approved a share repurchase program totaling $10 billion that

replaced a prior program. In November 2008, we announced that, in light of our business outlook, we were

temporarily suspending our open-market share repurchase program. In January 2010, we resumed

open-market purchases of shares under this program.

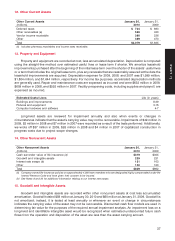

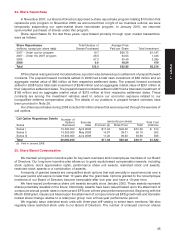

Share repurchases for the last three years, repurchased primarily through open market transactions,

were as follows:

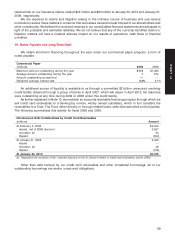

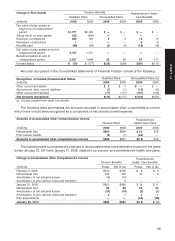

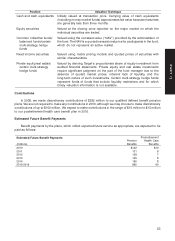

Share Repurchases Total Number of Average Price

(millions, except per share data) Shares Purchased Paid per Share Total Investment

2007 – Under a prior program 19.7 $60.72 $1,197

2007 – Under the 2007 program 26.5 54.64 1,445

2008 67.2 50.49 3,395

2009 9.9 48.54 479

Total 123.3 $52.85 $6,516

Of the shares reacquired and included above, a portion was delivered upon settlement of prepaid forward

contracts. The prepaid forward contracts settled in 2009 had a total cash investment of $56 million and an

aggregate market value of $60 million at their respective settlement dates. The prepaid forward contracts

settled in 2008 had a total cash investment of $249 million and an aggregate market value of $251 million at

their respective settlement dates. The prepaid forward contracts settled in 2007 had a total cash investment of

$165 million and an aggregate market value of $215 million at their respective settlement dates. These

contracts are among the investment vehicles used to reduce our economic exposure related to our

nonqualified deferred compensation plans. The details of our positions in prepaid forward contracts have

been provided in Note 26.

Our share repurchases during 2008 included 30 million shares that were acquired through the exercise of

call options.

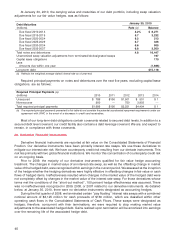

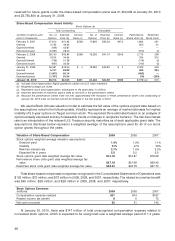

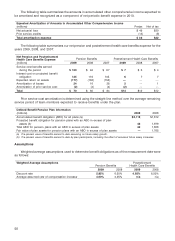

Call Option Repurchase Details Number of (amounts per share)

Options Exercise Total Cost

Series Exercised Date Premium (a) Strike Price Total (millions)

Series I 10,000,000 April 2008 $ 11.04 $40.32 $51.36 $ 514

Series II 10,000,000 May 2008 10.87 39.31 50.18 502

Series III 10,000,000 June 2008 11.20 39.40 50.60 506

Total 30,000,000 $11.04 $39.68 $50.71 $1,522

(a) Paid in January 2008.

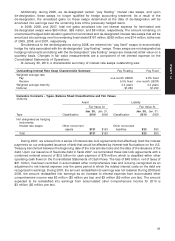

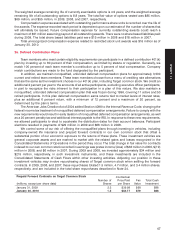

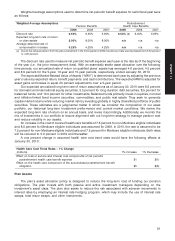

25. Share-Based Compensation

We maintain a long-term incentive plan for key team members and nonemployee members of our Board

of Directors. Our long-term incentive plan allows us to grant equity-based compensation awards, including

stock options, stock appreciation rights, performance share unit awards, restricted stock unit awards,

restricted stock awards or a combination of awards.

A majority of granted awards are nonqualified stock options that vest annually in equal amounts over a

four-year period and expire no later than 10 years after the grant date. Options granted to the nonemployee

members of our Board of Directors become exercisable after one year and have a 10-year term.

We have issued performance share unit awards annually since January 2003. These awards represent

shares potentially issuable in the future; historically, awards have been issued based upon the attainment of

compound annual growth rates in revenue and EPS over a three year performance period. Beginning with the

March 2009 grant, issuance is based upon the attainment of compound annual EPS growth rate and domestic

market share change relative to a retail peer group over a three-year performance period.

We regularly issue restricted stock units with three-year cliff vesting to select team members. We also

regularly issue restricted stock units to our Board of Directors. The number of unissued common shares

45

PART II