Target 2009 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2009 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

exceptions, are no longer subject to state and local or non-U.S. income tax examinations by tax authorities for

years before 2003.

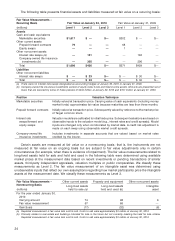

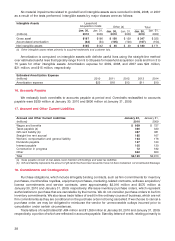

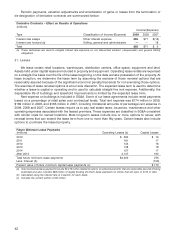

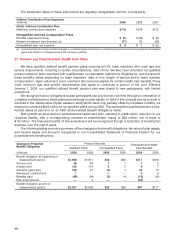

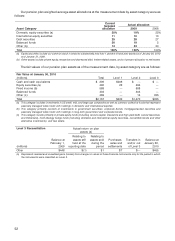

Reconciliation of Unrecognized Tax Benefit Liabilities

(millions) 2009 2008

Balance at beginning of period $434 $442

Additions based on tax positions related to the current year 119 27

Additions for tax positions of prior years 47 100

Reductions for tax positions of prior years (61) (101)

Settlements (87) (34)

Balance at end of period $452 $434

If the Corporation were to prevail on all unrecognized tax benefit liabilities recorded, approximately

$210 million of the $452 million reserve would benefit the effective tax rate. In addition, the reversal of accrued

penalties and interest would also benefit the effective tax rate. Interest and penalties associated with

unrecognized tax benefit liabilities are recorded within income tax expense. During the year ended

January 30, 2010, we reversed accrued penalties and interest of approximately $10 million. During the years

ended January 31, 2009 and February 2, 2008, we recognized approximately $33 million, and $37 million,

respectively, in interest and penalties. We had accrued for the payment of interest and penalties of

approximately $127 million at January 30, 2010 and $153 million at January 31, 2009.

Included in the balance at January 30, 2010 and January 31, 2009 are $133 million and $116 million,

respectively, of liabilities for tax positions for which the ultimate deductibility is highly certain, but for which

there is uncertainty about the timing of such deductibility. Because of the impact of deferred tax accounting,

other than interest and penalties, the disallowance of the shorter deductibility period would not affect the

annual effective tax rate, but would accelerate the cash payment to the taxing authority to an earlier period.

During 2010, we will file a tax accounting method change allowed under applicable tax regulations that will

determine the timing of deductions for one of our tax positions. Accordingly, this change will result in a

decrease in the unrecognized tax benefit liability of approximately $130 million in the next twelve months.

Additionally, it is reasonably possible that the amount of the unrecognized tax benefit liabilities with respect to

other of our unrecognized tax positions will increase or decrease during the next twelve months; however, we

do not currently expect any change to have a significant effect on our results of operations or our financial

position.

During 2009, we filed income tax returns that included tax accounting method changes allowed under

applicable tax regulations. These changes resulted in a substantial increase in tax deductions related to

property and equipment, resulting in an increase in noncurrent deferred income tax liabilities of approximately

$300 million and a corresponding increase in current income taxes receivable, which is classified as other

current assets in the Consolidated Statements of Financial Position. These changes did not affect income tax

expense for 2009.

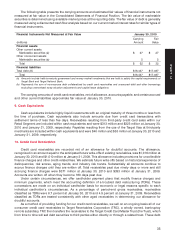

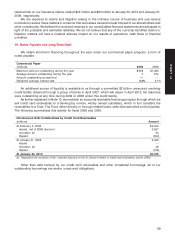

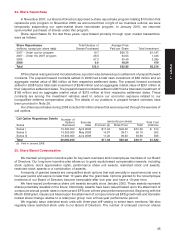

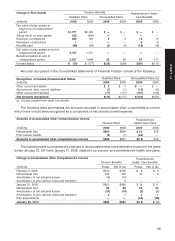

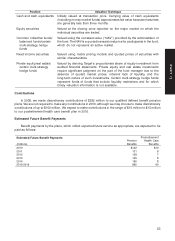

23. Other Noncurrent Liabilities

Other Noncurrent Liabilities January 30, January 31,

(millions) 2010 2009

Income tax liability $ 579 $ 506

Workers’ compensation and general liability 490 506

Deferred compensation 369 309

Pension and postretirement health care benefits 178 318

Other 290 298

Total $1,906 $1,937

We retain a substantial portion of the risk related to certain general liability and workers’ compensation

claims. Liabilities associated with these losses include estimates of both claims filed and losses incurred but

not yet reported. We estimate our ultimate cost based on analysis of historical data and actuarial estimates.

General liability and workers’ compensation liabilities are recorded at our estimate of their net present value.

44