Target 2009 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2009 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

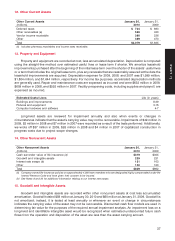

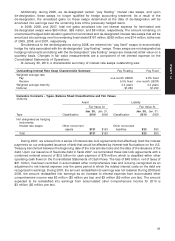

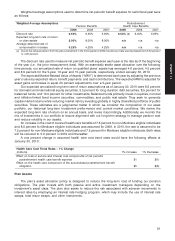

The weighted average remaining life of currently exercisable options is 4.9 years, and the weighted average

remaining life of all outstanding options is 8.8 years. The total fair value of options vested was $85 million,

$69 million, and $55 million, in 2009, 2008, and 2007, respectively.

Compensation expense associated with outstanding performance share units is recorded over the life of

the awards. The expense recorded each period is dependent upon our estimate of the number of shares that

will ultimately be issued. Future compensation expense for currently outstanding awards could reach a

maximum of $51 million assuming payout of all outstanding awards. There were no share based liabilities paid

during 2009. The total share based liabilities paid were $15 million in 2008 and $18 million in 2007.

Total unrecognized compensation expense related to restricted stock unit awards was $16 million as of

January 30, 2010.

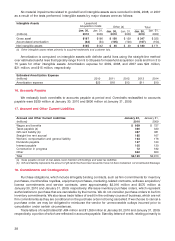

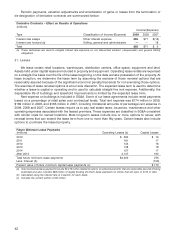

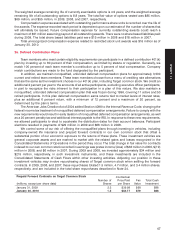

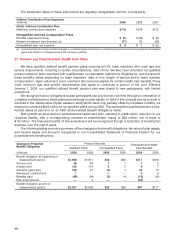

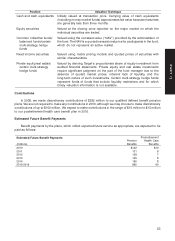

26. Defined Contribution Plans

Team members who meet certain eligibility requirements can participate in a defined contribution 401(k)

plan by investing up to 80 percent of their compensation, as limited by statute or regulation. Generally, we

match 100 percent of each team member’s contribution up to 5 percent of total compensation. Company

match contributions are made to the fund designated by the participant.

In addition, we maintain nonqualified, unfunded deferred compensation plans for approximately 3,500

current and retired team members. These team members choose from a menu of crediting rate alternatives

that are the same as the investment choices in our 401(k) plan, including Target common stock. We credit an

additional 2 percent per year to the accounts of all active participants, excluding executive officer participants,

in part to recognize the risks inherent to their participation in a plan of this nature. We also maintain a

nonqualified, unfunded deferred compensation plan that was frozen during 1996, covering 11 active and 50

retired participants. In this plan deferred compensation earns returns tied to market levels of interest rates,

plus an additional 6 percent return, with a minimum of 12 percent and a maximum of 20 percent, as

determined by the plan’s terms.

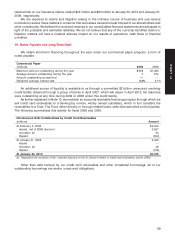

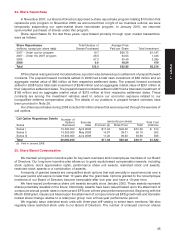

The American Jobs Creation Act of 2004 added Section 409A to the Internal Revenue Code, changing the

federal income tax treatment of nonqualified deferred compensation arrangements. Failure to comply with the

new requirements would result in early taxation of nonqualified deferred compensation arrangements, as well

as a 20 percent penalty tax and additional interest payable to the IRS. In response to these new requirements,

we allowed participants to elect to accelerate the distribution dates for their account balances. Participant

elections resulted in payments of $29 million in 2009 and $86 million in 2008.

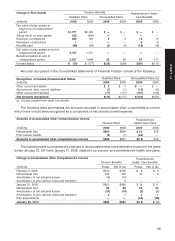

We control some of our risk of offering the nonqualified plans through investing in vehicles, including

company-owned life insurance and prepaid forward contracts in our own common stock that offset a

substantial portion of our economic exposure to the returns of these plans. These investment vehicles are

general corporate assets and are marked to market with the related gains and losses recognized in the

Consolidated Statements of Operations in the period they occur. The total change in fair value for contracts

indexed to our own common stock recorded in earnings was pretax income/(loss) of $36 million in 2009, $(19)

million in 2008, and $6 million in 2007. During 2009 and 2008, we invested approximately $34 million and

$215 million, respectively, in such investment instruments, and these investments are included in the

Consolidated Statements of Cash Flows within other investing activities. Adjusting our position in these

investment vehicles may involve repurchasing shares of Target common stock when settling the forward

contracts. In 2009, 2008, and 2007, these repurchases totaled 1.5 million, 4.7 million, and 3.4 million shares,

respectively, and are included in the total share repurchases described in Note 24.

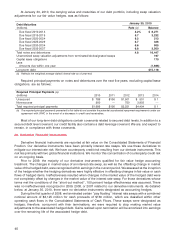

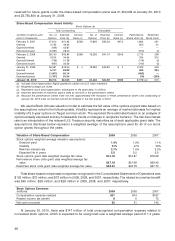

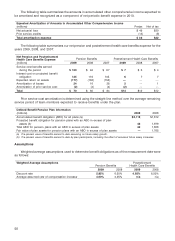

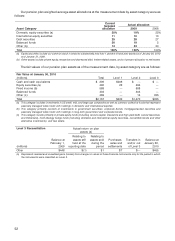

Prepaid Forward Contracts on Target Common Stock Contractual

Number of Price Paid Fair Total Cash

(millions, except per share data) Shares per Share Value Investment

January 31, 2009 2.2 $39.98 $68 $88

January 30, 2010 1.5 $42.77 $79 $66

47

PART II