Target 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

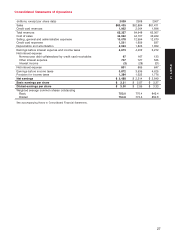

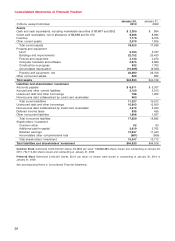

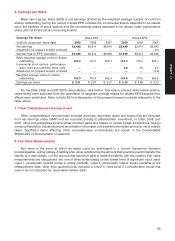

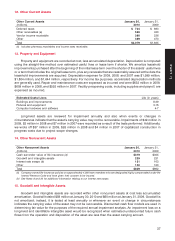

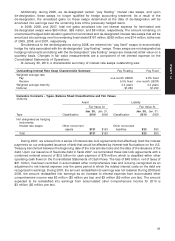

The following table presents financial assets and liabilities measured at fair value on a recurring basis:

Fair Value Measurements –

Recurring Basis Fair Value at January 30, 2010 Fair Value at January 31, 2009

(millions) Level 1 Level 2 Level 3 Level 1 Level 2 Level 3

Assets

Cash and cash equivalents

Marketable securities $1,617 $ — $— $302 $ — $—

Other current assets

Prepaid forward contracts 79 — — 68 — —

Equity swaps ——— 1——

Other noncurrent assets

Interest rate swaps (a) — 131 — — 163 —

Company-owned life insurance

investments (b) — 305 — — 296 —

Total $1,696 $436 $— $371 $459 $—

Liabilities

Other noncurrent liabilities

Interest rate swaps $— $23 $— $— $30 $—

Total $— $23 $— $— $30 $—

(a) There were no interest rate swaps designated as accounting hedges at January 30, 2010 or January 31, 2009.

(b) Company-owned life insurance investments consist of equity index funds and fixed income assets. Amounts are presented net of

loans that are secured by some of these policies of $244 million at January 30, 2010 and $197 million at January 31, 2009.

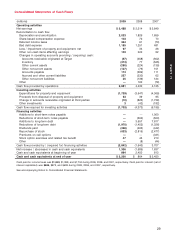

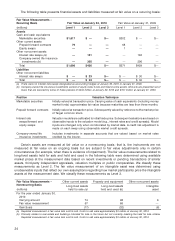

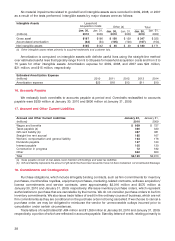

Position Valuation Technique

Marketable securities Initially valued at transaction price. Carrying value of cash equivalents (including money

market funds) approximates fair value because maturities are less than three months.

Prepaid forward contracts Initially valued at transaction price. Subsequently valued by reference to the market price

of Target common stock.

Interest rate Valuation models are calibrated to initial trade price. Subsequent valuations are based on

swaps/forward and observable inputs to the valuation model (e.g., interest rates and credit spreads). Model

equity swaps inputs are changed only when corroborated by market data. A credit risk adjustment is

made on each swap using observable market credit spreads.

Company-owned life Includes investments in separate accounts that are valued based on market rates

insurance investments credited by the insurer.

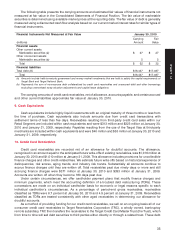

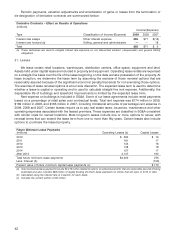

Certain assets are measured at fair value on a nonrecurring basis; that is, the instruments are not

measured at fair value on an ongoing basis but are subject to fair value adjustments only in certain

circumstances (for example, when there is evidence of impairment). The fair value measurements related to

long-lived assets held for sale and held and used in the following table were determined using available

market prices at the measurement date based on recent investments or pending transactions of similar

assets, third-party independent appraisals, valuation multiples or public comparables. We classify these

measurements as Level 2. The fair value measurement of an intangible asset was determined using

unobservable inputs that reflect our own assumptions regarding how market participants price the intangible

assets at the measurement date. We classify these measurements as Level 3.

Fair Value Measurements – Other current assets Property and equipment Other noncurrent assets

Nonrecurring Basis Long-lived assets Long-lived assets Intangible

(millions) held for sale (a) held and used (b) asset

For the year ended January 30,

2010:

Carrying amount 74 98 6

Fair value measurement 57 66 —

Gain/(loss) (17) (32) (6)

(a) Reported measurement is fair value less cost to sell. Costs to sell were approximately $3 million at January 30, 2010.

(b) Primarily relates to real estate and buildings intended for sale in the future but not currently meeting the held for sale criteria.

Reported measurement is fair value less cost to sell. Costs to sell were approximately $3 million at January 30, 2010.

34