Target 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

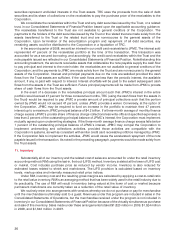

retained risk on our insurance claims, totaled $72 million and $64 million at January 30, 2010 and January 31,

2009, respectively.

We are exposed to claims and litigation arising in the ordinary course of business and use various

methods to resolve these matters in a manner that we believe serves the best interest of our shareholders and

other constituents. We believe the recorded reserves in our consolidated financial statements are adequate in

light of the probable and estimable liabilities. We do not believe that any of the currently identified claims or

litigation matters will have a material adverse impact on our results of operations, cash flows or financial

condition.

19. Notes Payable and Long-Term Debt

We obtain short-term financing throughout the year under our commercial paper program, a form of

notes payable.

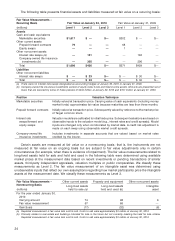

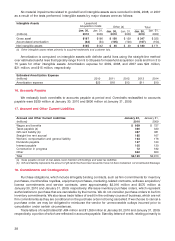

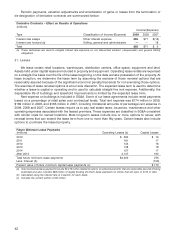

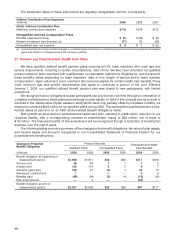

Commercial Paper

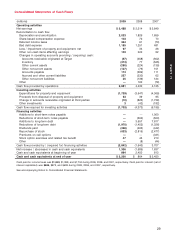

(millions) 2009 2008

Maximum amount outstanding during the year $112 $1,385

Average amount outstanding during the year 1274

Amount outstanding at year-end ——

Weighted average interest rate 0.2% 2.1%

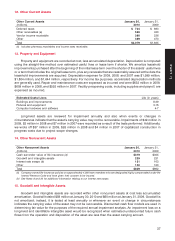

An additional source of liquidity is available to us through a committed $2 billion unsecured revolving

credit facility obtained through a group of banks in April 2007, which will expire in April 2012. No balances

were outstanding at any time during 2009 or 2008 under this credit facility.

As further explained in Note 10, we maintain an accounts receivable financing program through which we

sell credit card receivables to a bankruptcy remote, wholly owned subsidiary, which in turn transfers the

receivables to a Trust. The Trust, either directly or through related trusts, sells debt securities to third parties.

The following summarizes this activity for fiscal 2008 and 2009.

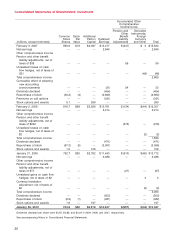

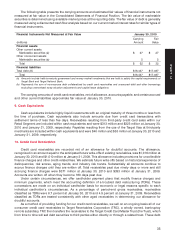

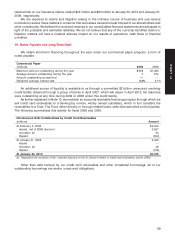

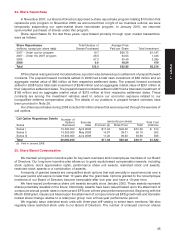

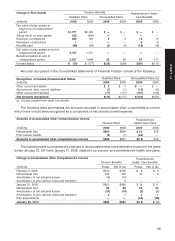

Nonrecourse Debt Collateralized by Credit Card Receivables

(millions) Amount

At February 2, 2008 $2,400

Issued, net of $268 discount 3,557

Accretion (a) 33

Repaid (500)

At January 31, 2009 5,490

Issued —

Accretion (a) 48

Repaid (163)

At January 30, 2010 $5,375

(a) Represents the accretion of the 7 percent discount on the 47 percent interest in credit card receivables sold to JPMC.

Other than debt backed by our credit card receivables and other immaterial borrowings, all of our

outstanding borrowings are senior, unsecured obligations.

39

PART II