Target 2009 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2009 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

constituencies: guests, team members, the communities in which we operate, and shareholders. To be

successful in the future, we must continue to preserve, grow and leverage the value of our brand. Brand value

is based in large part on perceptions of subjective qualities, and even isolated incidents that erode trust and

confidence, particularly if they result in adverse publicity, governmental investigations or litigation, can have

an adverse impact on these perceptions and lead to tangible adverse affects on our business, including

consumer boycotts, loss of new store development opportunities, or team member recruiting difficulties.

We are highly susceptible to the state of macroeconomic conditions and consumer confidence in the

United States.

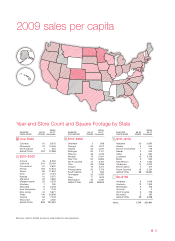

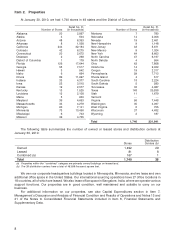

All of our stores are located within the United States, making our results highly dependent on U.S.

consumer confidence and the health of the U.S. economy. In addition, a significant portion of our total sales is

derived from stores located in five states: California, Texas, Florida, Minnesota and Illinois, resulting in further

dependence on local economic conditions in these states. Deterioration in macroeconomic conditions and

consumer confidence could negatively affect our business in many ways, including slowing sales growth or

reduction in overall sales, and reducing gross margins.

In addition to the impact of macroeconomic conditions on our retail sales, these same considerations

impact the success of our Credit Card Segment, as any deterioration can adversely affect cardholders’ ability

to pay their balances and we may not be able to anticipate and respond to changes in the risk profile of our

cardholders when extending credit, resulting in higher bad debt expense. The recent Credit Card

Accountability, Responsibility and Disclosure Act of 2009 has significantly restricted our ability to make

changes to cardholder terms that are commensurate with changes in the risk profile of our credit card

receivables portfolio. Demand for consumer credit is also impacted by macroeconomic conditions and other

factors, and our performance can also be adversely affected by consumer decisions to use debit cards or

other forms of payment.

If we do not effectively manage our large and growing workforce, our results of operations could be

adversely affected.

With over 350,000 team members, our workforce costs represent our largest operating expense, and our

business is dependent on our ability to attract, train and retain a growing number of qualified team members.

Many of those team members are in entry-level or part-time positions with historically high turnover rates. Our

ability to meet our labor needs while controlling our costs is subject to external factors such as unemployment

levels, prevailing wage rates, health care and other benefit costs and changing demographics. If we are

unable to attract and retain adequate numbers of qualified team members, our operations, guest service

levels and support functions could suffer. Those factors, together with increasing wage and benefit costs,

could adversely affect our results of operations.

Lack of availability of suitable locations in which to build new stores could slow our growth, and

difficulty in executing plans for new stores, expansions and remodels could increase our costs and

capital requirements.

Our future growth is dependent, in part, on our ability to build new stores and expand and remodel

existing stores in a manner that achieves appropriate returns on our capital investment. We compete with

other retailers and businesses for suitable locations for our stores. In addition, for many sites we are

dependent on a third party developer’s ability to acquire land, obtain financing and secure the necessary

zoning changes and permits for a larger project, of which our store may be one component. Turmoil in the

financial markets has made it difficult for third party developers to obtain financing for new projects. Local land

use and other regulations applicable to the types of stores we desire to construct may affect our ability to find

suitable locations and also influence the cost of constructing, expanding and remodeling our stores. A

significant portion of our expected new store development activity is planned to occur within fully developed

markets, which is generally a more time-consuming and expensive undertaking than developments in

undeveloped suburban and ex-urban markets.

5

PART I